Entertainment

/ArcaMax

Most popular TV shows on Netflix last week

It's been 12 years since Netflix changed the way we watch television with the release of its first original series, "Lilyhammer" and "House of Cards," and nothing has been the same since. The binge model, where all episodes are released at once, upended our viewing patterns and got us hooked on new shows in a way we hadn't been before—who ...Read more

Most popular movies on Netflix last week

When Netflix began as a service to mail DVDs to your home, none of us could have imagined what it would one day become. Of course, people now know Netflix as one of the most successful streaming services, as well as the producer of a number of smash hit original TV series and movies. The earliest Netflix films may not have broken through, but...Read more

Does your neighborhood sound expensive? Here's how names impact real estate prices.

In 2012, real estate agents in Oakland, California, began listing houses under a new neighborhood called "NOBE." The acronym—a conjunction meant to represent the North Oakland, South Berkeley, and East Emeryville neighborhoods—quickly spread online, irking its residents. A marketing tool to attract affluent homebuyers and renters, NOBE ...Read more

Cryptocurrency scams drive major spike in investment fraud

It started with a text message, seemingly meant for someone else. Ed Hayduk, a Pennsylvania resident, replied. Over the following weeks, he engaged in what he described to CBS News Philadelphia as a friendly conversation. Eventually, the sender convinced him to invest a small sum in a crypto wallet. Fake statements showing high returns ...Read more

As college enrollment declines, interest in these majors is growing for the 2024-25 school year

For the past decade, college enrollment has steadily declined; at the same time, students' career aspirations have undergone a dramatic transformation. Long considered the gateway to financial stability, a college degree is no longer viewed as the only—or even the best—path to success.

Freshman enrollment fell 5% this fall compared to ...Read more

The 'Got Milk?' era has given way to plant-based alternatives. Here's why.

In 1993, up-and-coming Hollywood director Michael Bay created a formative piece of '90s pop culture: the very first "Got Milk?" television commercial.

The iconic ad occurs inside a dimly lit Alexander Hamilton museum, where actor Sean Whalen spreads goopy peanut butter over slices of bread. As he subsequently scarfs down his sandwich, he ...Read more

As more parents abstain from vaccinations, children from low-income households may pay the price

For many American children, it's a rite of passage: Visit the pediatrician for a routine checkup, get a quick jab in the thigh or upper arm, and go home with a brightly colored bandage, a lollipop, and lifelong protection against a dangerous and deadly disease. Vaccines, one of the most important public health advances of the 21st century, have...Read more

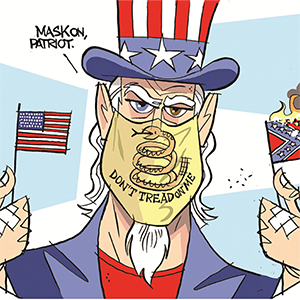

What state seals say about America and what they don't

The United States of America isn't short on symbols that evoke a sense of national patriotism—from "the stars and stripes" to the Statue of Liberty and even Uncle Sam. To truly understand the U.S., you must look past Washington D.C. and the White House and delve into the individual states—because the plurality of the nation's 50 states is ...Read more

As the Real ID deadline looms, will middle names create complications in a digitized system?

If you're headed to the airport soon, you might want to double-check your identification. Starting May 7, 2025, every resident (18 years or older) of a U.S. state or territory attempting to board a commercial aircraft will need to present security with a Real ID license or identification card, or another acceptable form of identification such ...Read more

American workers are getting lonelier. Having a 'third place' may help.

Jessica Maier, an art history professor at Mount Holyoke College and mother of three, realized about three years ago that something was missing—even though her days were always busy and close to bursting with tasks and responsibilities.

"I felt like all I was doing was being stressed all the time, thinking about other people, like my kids,...Read more

Our emails, ourselves: What the history of email reveals about us

save_the_drama_for_your_mama@hotmail.com

magically_delicious_vic@hotmail.com

gigglybear4u@hotmail.com

Gen Xers and millennials, in particular, have many embarrassing email addresses hidden in their digital closets. Still, it seemed like a good idea at the time. In the 1990s and early 2000s, the emergence of webmail services like ...Read more

From New York to LA, public transportation is turning high-tech

Across the world, public transit is going high-tech. With smartphones in people's pockets, transit agencies have learned to adapt—using QR codes and digital advancements to speed up payments and guide passengers through systems.

QR codes displayed at bus stops and train stations give folks access to maps, schedules, and updates via ...Read more

Olivia and Liam take top spots as most popular baby names again, except in these states

Liam and Olivia have once again topped the list of the most popular baby names in the United States, according to data from the Social Security Administration as of March 2024. This marks another year in which both names have captured the affection of new parents, continuing a relatively steady trend.

Liam has held the title of the most ...Read more

Who are the 26 million Americans without health insurance?

Many ominous ills are likely curable, especially if you have insurance. Without it, patients can find themselves facing life-threatening consequences, as physician Ricardo Nuila, an associate professor of medicine at Baylor College of Medicine in Houston, told Public Health Watch. Nuila had a stage 1 cancer patient who lost his insurance just ...Read more

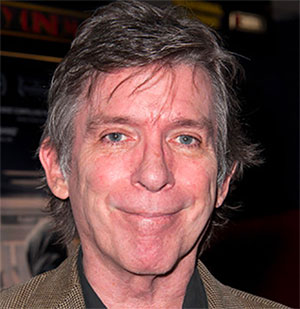

You look like a Michael: What research shows about how names shape your life

Names matter—or do they? They are the first things we receive. They reflect our parents' hopes or honoring heritage; they are formative. Our name will be spoken to us repeatedly, in praise, anger, and all tones between. It's usually the first thing people know about us. For some, it can be something to live up to or something to live down.

...Read more

5 most surprising Masters champions of the last 50 years

The Masters is arguably the second-most prestigious golf tournament in the world behind The Open. A victory can make a career, and missing out can forever relegate a player to the sport's second tier. The grand stage means slipups will be detailed in history books, while legendary shots will reverberate for eternity.

In this look at the ...Read more

The Social Security data breach compromised 'billions' of accounts. Here's how to protect yourself.

In early 2024, background checking service National Public Data was hit by a massive cyberattack that potentially compromised the sensitive, personal information of millions, or possibly even billions, of people around the world, including U.S. residents.

A year later, new security threats have gained traction. While artificial intelligence ...Read more

How vehicle safety regulations have changed over the past 50 years

When it comes to getting around, driving a car is the riskiest mode of transportation. The Insurance Institute for Highway Safety reports that 42,514 motor vehicle fatalities occurred in the United States in 2022, compared with under 1,600 fatalities for air, railroad, and transit travel combined, per Bureau of Transportation Statistics.

Car...Read more

7 chemicals found in everyday products that might be harming your health

Microplastics in single-use water bottles, phthalates in nail polish, and BPA in canned food containers—it's hard to avoid questionable chemicals in today's world.

With so many potential dangers in everyday objects, consumers may feel rightfully overwhelmed. And it certainly doesn't help that some companies have chosen to tout their ...Read more

As tariffs loom and global currency values fluctuate, goods from these top US trade partners may shift in price

Since his reelection, President Trump has followed through on campaign promises to impose tariffs on America's biggest trading partners—Canada, China, and Mexico—in an attempt to further his terms on trade, borders, and drug trafficking crackdowns. But the tariff threats, reversals, deals, and reprisals are leaving consumers, businesses, ...Read more