Entertainment

/ArcaMax

Tick bites are on the rise. Here's how to protect yourself.

Longer summers and shorter winters in North America mean more warm days throughout the year. These conditions are also creating longer life cycles for native arachnids, including bloodsucking ticks.

During the height of tick season in 2024, emergency departments saw 112 tick bites per 100,000 visits—the highest level since May 2019, ...Read more

Chronic pain is extremely common. What is it, and why is it so hard for many Americans to get relief?

Muscle and joint aches. Shooting, stinging, or burning pain. Ongoing stiffness or squeezing sensations, pain so persistent and intense that it leads to constant fatigue, anxiety, depression, and insomnia.

These and other symptoms of chronic pain are often associated with older adults, but chronic pain is a pervasive public health issue that ...Read more

Retirement, interrupted: Why those over 55 are a fast-growing segment of the workforce

Joan Madden-Ceballos, a 65-year-old health care administrator, has a working life in California many would envy. Her work is flexible, fulfilling, and something she enjoys going back to day after day. "I'm a baby boomer, so work is sort of ingrained in our lives," she told Vox.

While it may sound unusual for some to work past what many ...Read more

The most and least hospitable states for electric vehicle ownership

The number of people purchasing and using electric vehicles in the United States reached record levels in 2024, thanks to a combination of federal, state, and local incentives and growing awareness about the impact of greenhouse gases on climate change. However, recent moves by the Trump administration to curb incentives to buy EVs, such as tax...Read more

Top 10 crypto disasters explained, and how to protect yourself

Bitcoin surged past $100,000 in early December as investors and boosters salivated. They likely envisioned a friendlier regulatory environment under President Donald Trump, who declared in an August post on the social platform X that the U.S. would be "the crypto capital of the planet."

But before investors count their chickens or fork over ...Read more

The Great Wealth Transfer in 3 charts

More than $80 trillion over 20 years—that's the scale of the coming wave of wealth expected to trickle down to younger Americans over the next two decades.

Dubbed the Great Wealth Transfer, the shift of assets from older generations to millennials and Generation Z may profoundly reshape financial influence and spending priorities in ...Read more

5 interior design trends that are making major comebacks

The old adage that everything old is new again almost always proves true when it comes to fashion and design—just wait long enough, and what's cool will inevitably cycle back. Thought you'd never see the return of low-waisted jeans or built-in appliances in shades of avocado green? Think again. The cyclical nature of trends follows what ...Read more

Is your phone actually listening to you? We fact-checked 5 surveillance myths.

Mirrors that track workout reps, pillows that silence snores—smart technology is constantly evolving. Our phones are some of the smartest and most ubiquitous. By 2024, 9 in 10 Americans owned a smartphone, up from just 35% in 2011, according to Pew Research Center.

While these innovations offer convenience, they often come with a hidden ...Read more

Top pizza chains in the US

Pizza has been a staple of the American diet since the late 19th century and has grown into a multibillion-dollar industry. How much do Americans love pizza? $50 billion in estimated sales for 2024 should give you a rough idea. What's more, that number is expected to grow, with technology research company Technavio projecting the global pizza ...Read more

What a difference a dollar makes: These are the metros where your paycheck stretches the furthest

It's getting hard out there to be an everyday consumer. Prices are up, and so is unemployment. President Donald Trump's shifting positions on tariffs are contributing to a haze of economic uncertainty. Bracing for impact, shoppers are trimming their grocery runs and seeking discounts, and their confidence in the economy is plunging, according ...Read more

In an age of social isolation, here's the surprising way education shapes friendships

Romantic love may come and go, but finding the Thelma to your Louise is forever.

Friends—besties, squads, workplace buddies, college roommates—play a unique role in our lives. They're companions and confidants; they share our stories and know us better than we know ourselves. Whether they show up in real life or drop the perfect response...Read more

How do hurricanes affect baby names?

When a hurricane makes landfall, its effects go beyond the physical devastation and disruption to communities in its path. Storms leave lasting societal imprints on many facets of life—even what parents name their children.

Spokeo compared data from the National Oceanic and Atmospheric Administration and Social Security Administration to ...Read more

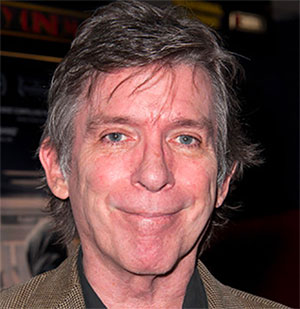

Most popular TV shows on Netflix last week

It's been 12 years since Netflix changed the way we watch television with the release of its first original series, "Lilyhammer" and "House of Cards," and nothing has been the same since. The binge model, where all episodes are released at once, upended our viewing patterns and got us hooked on new shows in a way we hadn't been before—who ...Read more

Most popular movies on Netflix last week

When Netflix began as a service to mail DVDs to your home, none of us could have imagined what it would one day become. Of course, people now know Netflix as one of the most successful streaming services, as well as the producer of a number of smash hit original TV series and movies. The earliest Netflix films may not have broken through, but...Read more

Does your neighborhood sound expensive? Here's how names impact real estate prices.

In 2012, real estate agents in Oakland, California, began listing houses under a new neighborhood called "NOBE." The acronym—a conjunction meant to represent the North Oakland, South Berkeley, and East Emeryville neighborhoods—quickly spread online, irking its residents. A marketing tool to attract affluent homebuyers and renters, NOBE ...Read more

Cryptocurrency scams drive major spike in investment fraud

It started with a text message, seemingly meant for someone else. Ed Hayduk, a Pennsylvania resident, replied. Over the following weeks, he engaged in what he described to CBS News Philadelphia as a friendly conversation. Eventually, the sender convinced him to invest a small sum in a crypto wallet. Fake statements showing high returns ...Read more

As college enrollment declines, interest in these majors is growing for the 2024-25 school year

For the past decade, college enrollment has steadily declined; at the same time, students' career aspirations have undergone a dramatic transformation. Long considered the gateway to financial stability, a college degree is no longer viewed as the only—or even the best—path to success.

Freshman enrollment fell 5% this fall compared to ...Read more

The 'Got Milk?' era has given way to plant-based alternatives. Here's why.

In 1993, up-and-coming Hollywood director Michael Bay created a formative piece of '90s pop culture: the very first "Got Milk?" television commercial.

The iconic ad occurs inside a dimly lit Alexander Hamilton museum, where actor Sean Whalen spreads goopy peanut butter over slices of bread. As he subsequently scarfs down his sandwich, he ...Read more

As more parents abstain from vaccinations, children from low-income households may pay the price

For many American children, it's a rite of passage: Visit the pediatrician for a routine checkup, get a quick jab in the thigh or upper arm, and go home with a brightly colored bandage, a lollipop, and lifelong protection against a dangerous and deadly disease. Vaccines, one of the most important public health advances of the 21st century, have...Read more

What state seals say about America and what they don't

The United States of America isn't short on symbols that evoke a sense of national patriotism—from "the stars and stripes" to the Statue of Liberty and even Uncle Sam. To truly understand the U.S., you must look past Washington D.C. and the White House and delve into the individual states—because the plurality of the nation's 50 states is ...Read more