Health

/ArcaMax

Do you have too much debt?

According to Bankrate’s 2025 Money and Mental Health Survey, almost half of U.S. adults (47%) say that money has a negative impact on their mental health. Nearly half (47%) of those say debt is one of the leading causes of this negative impact.

Unfortunately for Americans, debt is so common that it can be easy to dismiss or see rapid debt ...Read more

Why are rubber ducks mysteriously appearing on thrift store artworks?

ST. PAUL, Minn. -- Attention, Louvre Museum: It might be a good idea to keep Seamus Liam O’Brien away from the Mona Lisa.

Otherwise the St. Paul man might be tempted to paint a bright rubber duck somewhere on the famous painting and add his signature to da Vinci’s.

O’Brien is a scenic artist, sign painter and muralist with fine arts ...Read more

After the Eaton fire, they didn't think prom would happen. Now these teens are ready to dance

On a drizzling Saturday night, a herd of teenagers dressed in floor-length gowns and fitted suits enter a hotel ballroom through a blue and gold balloon arch. It's prom night for Pasadena's John Muir High School.

For the students whose graduating year was upended by the Eaton fire, the evening feels particularly monumental. About 175 John Muir ...Read more

On Gardening: Gardeners need snow for the summer season

It is May and The Garden Guy is here to tell you that your garden really needs more snow for the long growing season ahead. I’m talking about one of the best flowers you can add to the design of your mixed containers. That would be Snow Princess sweet alyssum, a Lobularia hybrid.

Snow Princess and I go way back to April 2009. That was the ...Read more

Birdman of Leavenworth? Famous Alcatraz inmate actually studied birds in Kansas

He was arguably the most famous prisoner ever housed at Alcatraz, the federal prison perched high on an island off the coast of San Francisco.

Meet Robert Stroud, aka the Birdman of Alcatraz.

But some bird lovers call him the “Birdman of Leavenworth.”

Stroud became famous for his work raising and studying canaries while in prison. But ...Read more

A fire killed four of his children. The survivors keep him going

ST. PAUL, Minn. — Last Halloween, the Vang siblings, Hnub Qub Ci Ntshiab, 3, and Cag Kub, 7, went trick-or-treating in St. Paul’s Cathedral Hill neighborhood, near their mother’s nursing home. The kids didn’t have costumes and toted their bounty in flimsy plastic bags. But they did, miraculously, have each other. And they had their ...Read more

Erika Ettin: Sarcasm and online dating: A tough pair

We’ve all been there: Someone we don’t know extremely well—maybe a work colleague or friend of a friend—sends a biting text that immediately causes you to raise your eyebrows. You may ask friends, “Hey...what do you think this means?” Internally, you’re debating whether you should ever talk to this person again ... or if it was ...Read more

Ask Anna: Love after baby -- Mother's Day advice for exhausted new parents

Dear Anna,

My husband and I welcomed our beautiful daughter six months ago, and while we're absolutely in love with her, I feel like my husband and I are just ships passing in the night. Between diaper changes, feedings and sleep deprivation, our relationship has taken a backseat. Date nights seem like a distant memory, and when we do have a ...Read more

Lori Borgman: Mother's Day celebrates the art of nurture

A real estate broker, an auctioneer and a columnist walk into a bar. Not really, but the setup is similar. I was standing with two friends, a man who sells real estate and a woman who appraises art and manages auctions. The three of us have known one another and one another’s families for years.

The man immigrated to the U.S. from Central ...Read more

Ex-etiquette: Love after loss

Q. My best friend’s husband passed away. She has been devastated and decided to join a grief group where she met a man who was also struggling with the loss of his wife. They hit it off, and although they each still maintain a separate residence, they stay together every night. They are both in their late 70s and were both married for over 50 ...Read more

7 tips to help dig your way out of debt

Getting rid of debt is a goal many Americans have. Not only does eliminating debt improve your financial health, but it is also likely to have a positive impact on your mental health. Assessing your outstanding balances, selecting a debt payoff strategy, and formulating a game plan are good starting points for getting out of debt once and for ...Read more

A 50-year-old pool in Black, rural SC closed. Then residents rallied to save it

COLUMBIA, S.C. -- For over 50 years, residents of the mostly Black, largely rural Lower Richland community have relied on the Hopkins Pool for swimming lessons, water aerobics and to be a gathering place on hot summer days.

But after those decades and almost no substantial repairs, the pool all but fell apart in 2023. Up to 1,000 gallons of ...Read more

Caretakers of tiny trees: Meet the oldest bonsai club in the US

SACRAMENTO, Calif. — The Sacramento Bonsai Club, which claims to be the oldest organization of its kind in the United States, celebrated its 79th annual Bonsai Show on Saturday at the Sacramento Buddhist Church in Land Park, featuring around 70 trees from across the region.

Since 1946, bonsai caretakers from Sacramento have shared their ...Read more

The Kid Whisperer: How educators can *actually* be nice at school

PART I of II

Dear Kid Whisperer,

I am the principal of a private, secular, K-8 school. Every year that I have been principal, the behaviors start out fine in the fall, and slowly deteriorate after that, no matter how hard we work at it. They are particularly bad in our middle school. Some of our programming involves having class meetings when ...Read more

Graduating seniors: We're leaving college in a 'time of uncertainty'

LEXINGTON, Ky. -- When Shelby Hamm graduated high school four years ago during the pandemic, she thought that would be the biggest challenge of her academic career.

“When the pandemic happened, and I was a junior in high school, it was really the first time that I had been looking towards the future, and now something from the outside that I...Read more

On a Philly high school visit, Duke of Edinburgh praises 'pioneers' embarking on a youth awards program named in his honor

PHILADELPHIA -- Prince Edward, the Duke of Edinburgh, on Wednesday commended 160 Philadelphia students as “pioneers.”

Pupils at four Philadelphia School District high schools have enrolled in the Duke of Edinburgh’s International Award — the first from any big-city district in the U.S. to take on the challenge.

The award, founded by ...Read more

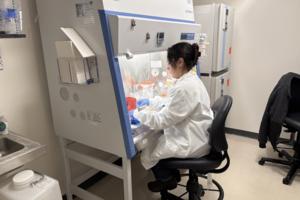

As a diversity grant dies, young scientists fear it will haunt their careers

Adelaide Tovar, a University of Michigan scientist who researches genes related to diabetes, used to feel like an impostor in a laboratory. Tovar, 32, grew up poor and was the first in her family to graduate from high school. During her first year in college, she realized she didn’t know how to study.

But after years of studying biology and ...Read more

Donald Trump has always treated America as his stage. But Americans don't want to be extras in their own life stories

Of all the roles that Donald Trump has held during the course of his life, the most consistent has been performer.

Whether he’s helming a real estate company, backing a string of casinos or bankrolling a football team; founding Trump University or purchasing Miss Universe; running for president or running the country, he makes sure to perform...Read more

Donald Trump has always treated America as his stage. But Americans don't want to be extras in their own life stories

Of all the roles that Donald Trump has held during the course of his life, the most consistent has been performer.

Whether he’s helming a real estate company, backing a string of casinos or bankrolling a football team; founding Trump University or purchasing Miss Universe; running for president or running the country, he makes sure to perform...Read more

How much stinky seaweed will South Florida see?

MIAMI — Piles of smelly seaweed have washed ashore on Miami Beach and Key Biscayne, a stinky reminder that this is sargassum season.

The brown seaweed is a common sight across the Caribbean and on South Florida beaches.

Researchers who track seaweed blooms expect 2025 to be another “major sargassum year” for the Atlantic Basin — but ...Read more

Popular Stories

- The Kid Whisperer: How educators can *actually* be nice at school

- 7 tips to help dig your way out of debt

- A 50-year-old pool in Black, rural SC closed. Then residents rallied to save it

- Caretakers of tiny trees: Meet the oldest bonsai club in the US

- Ask Anna: Love after baby -- Mother's Day advice for exhausted new parents