Legal & Insurance Considerations After a Single-Car Accident

Published in Health Articles

When a single-car accident occurs, the immediate aftermath can be overwhelming. Such incidents often leave drivers confused about the next steps. This is whether it’s sliding off an icy road or swerving to avoid an obstacle.

Understanding the legal and insurance landscape is crucial to protecting your interests and ensuring proper claims. This blog post aims to provide valuable insights into managing the accident aftermath.

Read as we offer guidance for anyone finding themselves in this challenging situation. Let’s get you started!

Police Report

The first thing to do after a single-car accident is to call the police. It’s essential to have an official record of the incident. This is even if no one was injured and there appears to be minimal damage.

The police report will serve as evidence when filing an insurance claim. It can also help determine fault in case of a dispute.

Moreover, some states require drivers to report any accidents and this is regardless of severity. Failure to do so may result in penalties or even suspension of your driver’s license. This is especially important to note for out-of-state drivers who may not be aware of local laws.

Liability Assessment

After the police have arrived and filed a report, it’s essential to assess liability. In single-car accidents, determining fault can be challenging as there are no other drivers involved. However, you should still gather evidence such as:

- photos of the scene

- witness statements

- relevant documents

All these may help establish your position. This information will be crucial when dealing with insurance companies.

Comprehensive Insurance Coverage

If you have comprehensive insurance coverage, it will typically cover the damages caused by a single-car accident. This type of insurance protects against incidents such as:

- theft

- vandalism

- natural disasters

However, it’s crucial to review your policy carefully and understand the extent of your coverage. Some policies may have exclusions or limitations that could affect your claim.

This is also an excellent time to review your deductibles. And, this can significantly impact the amount you receive in compensation.

Collision Insurance Coverage

Unlike comprehensive insurance, which covers non-collision-related damages, collision coverage protects against damages caused by a collision with another vehicle or object. If you have this type of coverage, it will typically cover the damages from a single-car accident.

Similar to comprehensive insurance, it’s essential to review your policy and understand any exclusions or limitations that could affect your claim. This coverage may also have a deductible, which you should be aware of when filing a claim.

Medical Payment Coverage

In the event of an injury caused by a single-car accident, medical payment coverage can help cover your medical expenses. This type of coverage is optional in most states but is highly recommended for drivers.

It’s essential to review your policy carefully. Make sure to understand the extent of your coverage regarding medical payments.

Some policies may have limitations or restrictions that could affect your claim. This coverage may also have a deductible. So, be sure to review your policy thoroughly.

Uninsured/Underinsured Motorist Coverage

In some single-car accidents, the cause may be an unidentified or uninsured driver. In such instances, your insurance policy’s uninsured/underinsured motorist coverage can provide compensation for damages.

It’s crucial to review your policy and understand the extent of your coverage regarding these types of incidents. This coverage may also have limitations or restrictions. So, it’s essential to review your policy carefully.

Legal Liability for Property Damage

If you were at fault in a single-car accident, you would likely be held legally liable for the damages. This means that you may have to pay for the repairs or replacement of any damaged property.

However, if you have comprehensive or collision insurance coverage, your insurance company will typically handle these costs on your behalf. This is an added benefit of having insurance and can save you from a significant financial burden.

Legal Liability for Personal Injury

In case of injuries resulting from a single-car accident, legal liability can become more complicated. If another party is injured as a result of your actions, they may file a lawsuit against you to recover their medical expenses and other damages.

Having proper insurance coverage can help protect against such lawsuits and ensure that all parties involved are fairly compensated. This is another reason why it’s important to review your insurance policy and make sure you have adequate coverage.

Potential Increase in Insurance Premiums

Unfortunately, being involved in a single-car accident can lead to an increase in your insurance premiums. This is because insurance companies consider you to be a higher-risk driver after such incidents.

To avoid this situation, it’s crucial to drive cautiously and obey traffic laws at all times. It’s also essential to review your policy regularly and make sure you have adequate coverage for potential accidents.

Personal Injury Protection

Some states have personal injury protection (PIP) coverage, which is mandatory for drivers. This type of coverage helps cover medical expenses and lost wages in case of injuries resulting from a single-car accident.

It’s essential to review your policy and understand the extent of your PIP coverage to ensure you have adequate protection in the event of a car crash. This coverage can help alleviate financial stress and allow you to focus on your recovery.

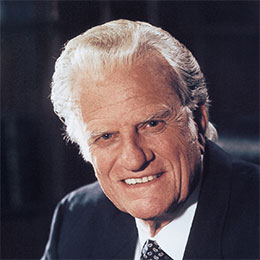

Legal Consultation

In some cases, it may be necessary to seek legal consultation after a single-car accident. This may be required if there are liability disputes or if an insurance company denies your claim.

It’s essential to consult with a qualified and experienced attorney from firms like Goldblatt + Singer in these situations to ensure that your rights are protected and you receive fair compensation for any damages incurred. This can also help alleviate the stress and burden of managing the aftermath of a single-car accident.

Know What to Consider After a Single-Car Accident

Being involved in a single-car accident can be a stressful and overwhelming experience. However, by understanding the legal and insurance landscape, you can protect your interests and ensure proper insurance claims.

It’s crucial to remember to call the police, assess liability, review your insurance coverage, and seek legal consultation if necessary. By following these steps, you can manage the aftermath of a single-car accident effectively.

To read more, visit our blog page. We do have more!

Comments