Gov. Newsom signs new law: Restaurants and bars can continue to charge service fees, if posted

Published in News & Features

Those 3, 5 and 20% fees at the bottom of your menu could be here to stay. With little time to spare, a new law will allow restaurants and bars to continue charging service fees, health care costs and other surcharges when listed clearly for diners to see. The practice was set to be outlawed on July 1.

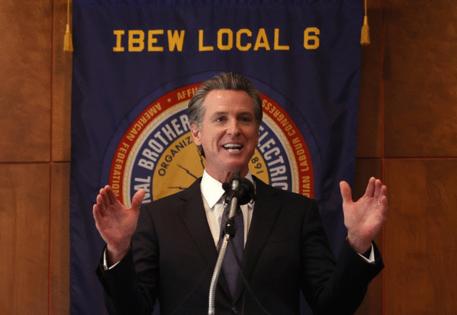

On Saturday, Gov. Gavin Newsom signed Senate Bill 1524, an emergency measure that would exempt California food and beverage vendors from Senate Bill 478: a law that goes into effect at the start of the month and targets ticket sellers, hotel and travel websites and other businesses that charge "hidden" or "junk" fees. Before SB 1524's introduction in early June, restaurants and bars were included in the affected professions, with Attorney General Rob Bonta advising that restaurants and bars roll surcharge fees into menu list prices to avoid the possibility of legal action.

"These deceptive fees prevent us from knowing how much we will be charged at the outset," Bonta, who co-sponsored SB 478, said in a statement the day it was signed. Bonta could not be reached for comment regarding SB 1524.

Numerous service-industry operators have been vocal against SB 478 since its passage in October, fearing that raising list prices during a tumultuous year marked by closures and inflation will only result in more loss of customers and support. Multiple restaurateurs told the Los Angeles Times that the process of revising or entirely overhauling their tipping and surcharge system could result in loss of staff benefits or all-out closures. SB 1524's passage and the continuation of these surcharges could affect tens of thousands of restaurants throughout the state.

"We're the most regulated of any business out there and we are struggling to survive in the broken system that has been handed to us throughout many, many decades," said Eddie Navarrette, a co-founder of restaurant-advocacy group the Independent Hospitality Coalition. "When you add more regulations, whatever it may be, it makes things more difficult. Things are already difficult…there is a mass exodus of our small-restaurant community. I think it's a huge relief, just to have one less thing being thrown at them right now."

Navarrette spent weeks campaigning for SB 1524's passage, writing letters, meeting with upward of 35 policy advisers, legislators or their representatives, knocking on doors at the State Capitol, and explaining the usage of service fees within the tip-based restaurant industry, which functions uniquely from most other fields that will be affected by SB 478.

Surcharges, health fees and service charges are regularly used within the industry to stabilize wages across dining rooms and kitchens — where servers often receive tips but cooks and dishwashers do not — and to help offset the cost of benefits such as health care. Businesses with larger service fees, such as 18% or 20%, often note that tip is not expected.

"It's confusing why the restaurants are claiming that they need to do things differently, because it just feels like they're saying that they need to hide the cost of their food for us and that doesn't feel right," said Jenn Engstrom, the state director of the California affiliate of the Public Interest Research Group, or CALPIRG. The nonprofit organization advocates for consumer interests and protections. "It feels like you're being duped, that's what it feels like: that they're trying to trick you."

Some local restaurants have come under fire for alleged misuse of charging service fees or other surcharges, though multiple chefs and restaurateurs told the Los Angeles Times that these "bad actors" are few and far between.

"Every restaurateur that I know who cares in this industry is using it in a way that is so immensely appropriate and responsible and forward-thinking that if it was to go away, it would be really crippling to everybody," Kato restaurateur Ryan Bailey told the Los Angeles Times earlier this year.

...continued

©2024 Los Angeles Times. Visit latimes.com. Distributed by Tribune Content Agency, LLC.

Comments