Terry Savage: Social Security Fairness Act passes

The Social Security Fairness Act was passed in the waning moments of Congress, just before the budget bill was approved. It essentially repeals the WEP and GPO – two acronyms familiar to the nearly 3 American retirees who found their earned Social Security benefits reduced by the “Windfall Elimination Provision” and the “Government Pension Offset.”

Those provisions kept millions of public service employees, including police officers, firefighters, postal workers, teachers and others with a public pension, from collecting their full Social Security benefits. The Fairness Act also ends a second provision that reduces Social Security benefits for those workers’ surviving spouses and family members.

Originally created during the last Social Security reform in the late 1970s and early 1980s, these offsets impacted workers who had “covered” employment at some point in their careers, where they paid into Social Security. But even though they had the required quarters of covered employment, their monthly benefits were reduced because they had also earned public pensions in jobs that did not pay into the Social Security system.

A broad spectrum of Congress agreed that it was unfair to reduce their earned benefits because they had these public pensions. After all, the vast majority of American workers get their full Social Security benefits, and also benefit from their 401(k) and IRA contributions over their working years.

Opposition to the Social Security Fairness Act centered around the costs of these additional payments. According to the Congressional Budget Office, the proposed legislation would add a projected $195 billion to federal deficits over a decade and bring the Social Security Trust Funds six months closer to becoming unable to make full promised payments. The Social Security actuaries report projects that event to happen in 10 years, in 2035.

The exact wording of the law says it will apply to benefits paid after December 2023. The implication is that any reductions not paid out in 2024 might be calculated and sent to beneficiaries in 2025, along with their full Social Security benefits. It remains to be seen whether the Social Security Administration will accept that wording, or rule that the full payments are not retroactive, but start with benefits paid after the law is signed, thus in 2025.

Special Note: In our book, "Social Security Horror Stories," economist Larry Kotlikoff and I pointed out that roughly one-third of those clawbacks came because Social Security did not correctly calculate the WEP offset for years and then belatedly started reviewing payments to those who also had public pensions. Suddenly, these people who relied on Social Security’s benefit calculations were told they must repay thousands of dollars because of calculation mistakes.

So, it’s likely asking too much to believe that suddenly the Social Security Administration will recalculate the correct benefits going forward. And very unlikely that it will drop the clawback demands for past overpayments! But if you want to know the “correct” benefit you should receive, without the WEP or GPO, you can go to www.MaximizeMySocialSecurity.com and, for a $49 fee, run the software, without including the fact that you have a public pension. That should give you the correct calculation of future benefits.

Either way, it is a victory for those who said the WEP and GPO unfairly penalized those who had worked in covered jobs and paid into the system. Now, the challenge is to deal with the basic funding issues of Social Security — likely by lifting the cap on taxable wages for Social Security ($176,100 in 2025), or by delaying the current full retirement age for younger workers who have at least 25 years to plan for a longer work life, or some other combination of funding solutions.

While fairness for those who paid into the system was a project that gathered wide support, the task of reforming Social Security to keep it solvent will demand a bipartisan effort on behalf of all American workers. And that’s The Savage Truth!

========

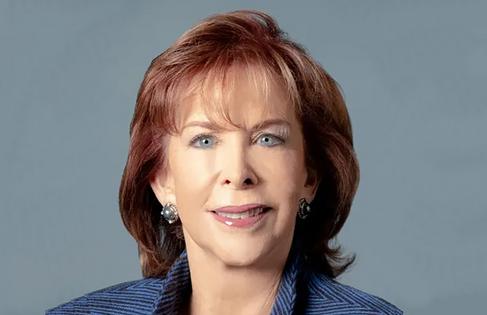

(Terry Savage is a registered investment adviser and the author of four best-selling books, including “The Savage Truth on Money.” Terry responds to questions on her blog at TerrySavage.com.)

©2024 Terry Savage. Distributed by Tribune Content Agency, LLC.

Comments