Business

/ArcaMax

Real estate Q&A: Should broker get part of deposit from failed sale?

Q: I hired a broker to sell my house in Florida. The first buyer backed out, so we agreed that I’d keep part of their deposit. I kept working with the same broker, and eventually, someone else bought the place. The broker got their full commission from that sale. Now the broker is asking for half of the deposit from the first buyer who bailed....Read more

With blowout probe done, lawsuits take off against Boeing, Alaska Air

Boeing and Alaska Airlines have settled one of many lawsuits filed against them after the January 2024 midflight blowout, while three more claims are set to go to trial next year.

Dozens of passengers on board Alaska Airlines Flight 1282 sued the airline and 737 maker Boeing, but those lawsuits have largely been on hold as the National ...Read more

US initial jobless claims decline for a fifth straight week

Applications for U.S. unemployment benefits declined for a fifth straight week to the lowest level since mid-April, showing a resilient job market.

First-time jobless claims decreased by 7,000 to 221,000 in the week ended July 12. The median forecast in a Bloomberg survey of economists called for 233,000 applications.

Continuing claims, a ...Read more

Trump says Coca-Cola agrees to use cane sugar for Coke in US

President Donald Trump said in a Truth Social post that Coca-Cola Co. has agreed to use cane sugar in Coke beverages sold in the US.

“I have been speaking to Coca-Cola about using REAL Cane Sugar in Coke in the United States, and they have agreed to do so,” Trump said. “I’d like to thank all of those in authority at Coca-Cola.”

Coca-...Read more

Tesla failed to stop Autopilot misuse, safety expert testifies

Tesla Inc. hasn’t done enough to protect against drivers misusing its Autopilot system, a safety expert testified at a trial over a 2019 fatal collision.

Mary “Missy” Cummings, an engineering professor at George Mason University, told jurors in Miami federal court that the Tesla owner’s manual, which contains critical warnings about how...Read more

These California tech hubs are set to dominate the AI economy

Despite suggestions it has been losing its edge, California is way ahead of others when it comes to the hottest technology right now: artificial intelligence.

The regions around San Francisco, San Jose and Los Angeles are among the top ranked in the country for AI, according to a report released Wednesday by the Brookings Institution.

The ...Read more

High time: Weed lounges are finally opening in New Jersey -- and they're coming this month

It’s easy to find a bar in Atlantic City — spots to grab a drink, hear live music, and hang with friends are everywhere. In a few short weeks, cannabis lounges will offer a similar vibe, but for weed.

On Tuesday, July 15, the New Jersey Cannabis Regulatory Commission voted to approve the state’s first cannabis consumption lounges. The ...Read more

The pandemic gave workers power. Now employers are taking it back

The federal government job was hybrid when Sarah Reynolds accepted it, meaning she could live in Hudson, Wisconsin, and work in St. Paul.

But within months of her landing in the Midwest — Reynolds’ fourth cross-country move for work in less than a decade — the federal government had called its employees to the office.

“This was not ...Read more

Where Wells Fargo plans to be 'more aggressive' seeking growth opportunities now

During Wells Fargo’s first earnings call since its $2 trillion asset cap was lifted, bank officials provided more details Tuesday about how they will grow and also improve company culture.

“When the asset cap was lifted, it’s not like this light switch is going to go off and all of a sudden things are going to dramatically change,” ...Read more

Silicon Valley Pain Index says poverty, inequality continue to plague South Bay

SAN JOSE, California — San Jose State University researchers unveiled new findings Wednesday that show poverty and inequality continue to plague Silicon Valley.

This year’s iteration of the Silicon Valley Pain Index, which provides more than two hundred statistics, aims to investigate “personal and community distress or suffering” in ...Read more

Chuck E. Cheese opens arcades for adults

For almost half a century Chuck E. Cheese has been a place “where a kid can be a kid.” But what happens when kids grow up?

Enter Chuck’s Arcade: a new concept branding itself as a place where an adult to be a kid.

One might think this concept would include beer and Chuck E. Cheese’s signature pizza alongside games. Several media ...Read more

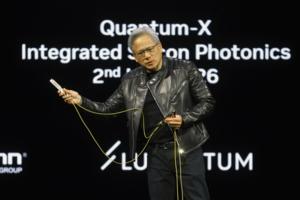

Nvidia is the first $4-trillion company. Here are three things to know

Nvidia is already the world's most valuable company being one of the biggest beneficiaries of the global artificial intelligence boom.

This week, the Santa Clara, California-based chip maker got another windfall.

The Jensen Huang-led technology giant on Monday received approval from the U.S. government to sell some of its AI chips in China, ...Read more

What feud? SpaceX launches competitor Amazon's Project Kuiper satellites

Just because Elon Musk and Jeff Bezos aren’t the best of friends and Amazon’s Project Kuiper will directly compete with SpaceX’s Starlink satellites for broadband internet doesn’t mean everyone can’t get along.

A SpaceX Falcon 9 rocket launched at 2:30 a.m. Wednesday with 24 of Amazon’s satellites from Cape Canaveral Space Force ...Read more

Motormouth: RPM or RPMs?

Q: I'm writing about your recent column where you answered a PHEV break-in period question. Oh, no: You wrote "...2,000 and 4,000 RPMs."

"RPM" is already plural! Revolutions per minute. Argh. As a mechanical engineer, I see this all the time, even in technical literature; it's an epidemic! Thanks for your consideration and your great column.

...Read more

Chicago 'granny flats,' coach houses one step closer to citywide legalization with vote

CHICAGO — Aldermen advanced a measure that could legalize “granny flats” citywide with limited restrictions, a move advocates say will create more affordable housing.

The City Council’s Zoning Committee voted 13-7 to advance the additional dwelling unit ordinance. The result tees up a Wednesday vote by the full City Council, when ...Read more

Big change coming for Las Vegas poker players at Strip casinos

A change in how, and where, poker players cash out after gambling on the Strip will begin later this week.

Multiple casino operators on the Strip, including Caesars Entertainment, MGM Resorts International and Wynn Resorts, will only cash out poker chips from their properties, ending any preexisting arrangements for accepting poker chips from ...Read more

Rights to Fyre Festival sell for $245K on eBay

The rights to the troubled Fyre Festival brand have sold for only $245,000 in an eBay auction.

The sale included IP, brand trademarks and social media assets.

The auction received a total of 175 bids with the final bid coming in early Tuesday afternoon.

Organizer Billy McFarland announced he was selling the brand in April, roughly a week ...Read more

Justin Fox: A '100% American' farm workforce? That's delusional

Want a job picking fruit? There are thousands available right now on the U.S. Department of Labor’s Seasonal Jobs website. Orchard work paying $19.82 an hour in Washington, $17.96 in Pennsylvania and $15.87 in West Virginia. Berry planting and picking jobs at $19.97 an hour in California, $16.23 in Florida and $16.08 in Georgia.

Employers ...Read more

Beyond missing pets and packages: How Nextdoor plans to reshape its social network

Nextdoor, the once-hot social network for neighborhoods, wants to claw its way back to the top and prove that people can use the platform for more than just finding lost cats.

The San Francisco company's shares have plunged more than 80% since its market debut in 2021. Nextdoor shined brightly when people locked at home during the COVID-19 ...Read more

Victims of gift card scam sue Target, allege Minneapolis retailer profited from fraud

Four fraud victims who were tricked by con artists into buying Target gift cards as part of scams allege the retailer is purposefully failing to catch criminals because the company profits from selling ill-gotten merchandise.

The victims, all residents of Pennsylvania, on Monday filed a putative class-action lawsuit against Minneapolis-based ...Read more

Popular Stories

- High time: Weed lounges are finally opening in New Jersey -- and they're coming this month

- These California tech hubs are set to dominate the AI economy

- Trump says Coca-Cola agrees to use cane sugar for Coke in US

- The pandemic gave workers power. Now employers are taking it back

- Tesla failed to stop Autopilot misuse, safety expert testifies