Politics

/ArcaMax

Editorial: When debate leads to death

Americans long ago decided to trade bullets for ballots. But this exchange isn’t the norm around the world — and isn’t inevitable here either.

The shooting of Charlie Kirk is more than just a horrible tragedy for his family and friends. It was an attack on civil discourse itself. That’s a grave threat to the country’s constitutional ...Read more

Editorial: Trump's attack on justice: Ousted prosecutor Erik Siebert was right to refuse a phony indictment of Tish James

Donald Trump’s destructive onslaught against the fair administration of justice and his politicization of prosecutorial power continues. That is what dictators do, which is one of the reasons Trump so admires them.

Trump has now fired Erik Siebert as the U.S. attorney for the Eastern District of Virginia for refusing to gin up phony mortgage ...Read more

David Mastio: Charlie Kirk memorial was a celebration of grace. Then Donald Trump spoke

“Grace is the enduring legacy of Charlie Kirk,” Vice President JD Vance said Sunday at a Glendale, Arizona, memorial for the assassinated conservative youth leader, not long before Kirk’s widow Erika built on that legacy, saying of the young Utah man who killed the father of her two young children, “I forgive him.”

If grace is Kirk’...Read more

Mary McNamara: Is Trump targeting broadcast TV because he was fired by NBC?

The recent suspension of “Jimmy Kimmel Live!” is an attack on democracy. Though not necessarily the democracy one might think.

Free speech is protected by the First Amendment. This grants the late-night host the freedom to say whatever he thinks without fear of arrest or state-sanctioned violence. It does not necessarily guarantee that he ...Read more

LZ Granderson: How media consolidation silences free speech

The latest smartphone from Apple hit stores this weekend and reportedly the bell of the ball is the iPhone 17 Pro Max. Customers want it for its advanced telephoto lens, large display and battery life. Investors want it to keep up with the Joneses. While Apple remains one of the globe's most valuable tech companies, there is growing concern on ...Read more

Leonard Greene: Jimmy Kimmel learns the hard way that free speech under Trump isn't always free

Here a little something everyone should know about free speech:

It’s not always free.

Late night TV host Jimmy Kimmel just found that out the hard way last week after ABC took him off the air over remarks he made about President Donald Trump and his MAGA followers in the wake of the Charlie Kirk assassination.

In the days since Kirk’s ...Read more

David M. Drucker: How Erika Kirk memorialized her late husband

Imagine your most cherished political figure was also your cultural north star and pastoral life coach. Now imagine he was felled by an assassin’s bullet. Then imagine there were millions of you.

That explains the tens of thousands of people, including President Donald Trump and the highest-ranking officials of the U.S. government, packing a ...Read more

Steve Lopez: If he ever gets his job back, I have just the hat for Jimmy Kimmel, thanks to Trump

These are dark times, the average cynic might argue.

But do not despair.

If you focus on the positive, rather than the negative, you'll have to agree that the United States of America is on top and still climbing.

Yes, protesters gathered Thursday outside "Jimmy Kimmel Live" in Hollywood to denounce ABC's suspension of the host and President ...Read more

Commentary: The cruel arithmetic of Trump's immigration crackdown

As summer 2025 winds down, the Trump administration’s deportation machine is operating at full throttle—removing over one million people in six months and fulfilling a campaign promise to launch the “largest deportation operation in American history.” For supporters, this is a victory lap for law and order. For the rest of the lot, it’...Read more

Martin Schram: An offer they feared to refuse

The lines read as if they wouldn’t be spoken until Marlon Brando finished stuffing that cotton in his mouth so he’d sound just right when “The Godfather” cameras rolled. But this time they sounded unmistakably clear.

“We can do this the easy way or the hard way,” a clear-speaking, cotton-free figure said, quite ominously. “…...Read more

Commentary: Grandparents for Vaccines group gains traction

We are grandparents. We are passionate, committed and yes, radical. Make no mistake about what we stand for. In the 1960s and 1970s, we marched for civil rights, fought and protested wars and demanded justice. Today, we march again. This time it’s personal: We are defending our grandchildren’s right to health, their right to vaccines.

The ...Read more

Editorial: Punish politicians who lie? Good luck with that, UK

No one struggles with moral quandaries quite like the British. In the plays of William Shakespeare alone, there’s a lesson in how not to deal with jealousy (Othello), how to screw up ambition (Macbeth) and the morality of revenge (Hamlet) with many, many more.

The royal family is an endless source for further examples of poor choices (albeit...Read more

Commentary: RFK jr.'s anti-vaccine crusade is a public health disaster

In April 2023, Robert F. Kennedy Jr. announced his presidential bid in Boston, promising to “Make America Healthy Again.” Since becoming President Donald Trump’s secretary of Health and Human Services, Kennedy has made a mockery of this promise, undermining decades of public health consensus.

His tenure recently reached its lowest point, ...Read more

Commentary: Why the government's subversion of data is so dangerous

In any stable democracy, trust in government data is critical. Without such freely shared and reliable information, it is impossible to assess the condition of the nation, what changes are necessary and how laws and policies will impact that condition. Unfortunately, the administration’s actions are eroding such trust.

Discovery fueled by ...Read more

Commentary: What Pam Bondi gets wrong about 'hate speech'

What is the federal offense of “hate speech”?

It’s a good question because there is no such offense. That didn’t stop U.S. Attorney General Pam Bondi from threatening to use the authority of her office to combat it. “We will absolutely target you, go after you,” she said, “if you are targeting anyone with hate speech.”

Bondi ...Read more

Commentary: In dark times, Americans need leadership that unites

The assassination of Charlie Kirk has cast a dark shadow over the country, not only because the deed itself was abominable, but also because the reaction to it has been so disturbing. Instead of bringing out the best in America, as tragedies once did, it is bringing out the worst — in both parties.

It should go without saying that political ...Read more

Ronald Brownstein: 'Color-blind' conservatism has some holes in its logic

The Supreme Court and President Donald Trump’s administration are mounting parallel crusades to virtually eliminate the use of race in government decision-making.

With one conspicuous exception.

Between them, the court’s Republican-appointed majority and the Trump administration have severely limited, and in some cases outright banned, the...Read more

Editorial: Liberation Day tariffs are an increasingly costly mistake

Amid the president’s blitz of tariff initiatives, the April “Liberation Day” scheme is an outlier. Rather than targeting specific products or countries to advance a policy goal, it imposed across-the-board duties, relied on vague justifications, and proved so harsh and omnidirectional that it induced a market crash. It was also premised on...Read more

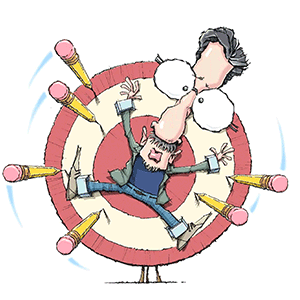

Noah Feldman: Blaming violence on free speech is a very old trick

In the wake of Charlie Kirk’s assassination, the Trump administration is following a very specific, very old script. It argues that political speech causes political violence, and that this speech must therefore be punished.

It is imperative that all defenders of free speech — whether on the left, right, or in the center — reject this ...Read more

Commentary: Jimmy Kimmel and the threat that comedy poses to autocrats

The abrupt suspension of comedian Jimmy Kimmel’s late-night show on ABC might seem like the least of our worries amid the shuttering of government agencies, the collapse of congressional checks on executive power and bands of ICE agents detaining people on the basis of race or language. But humor matters.

While the news media is sometimes ...Read more