David Fickling: Here's the best climate news you missed this year

Published in Op Eds

Those who follow the energy transition seem perpetually pitched between elation and despair. For every fragment of positive news — surging Chinese EV sales; record-low prices for solar panels and batteries — there is a dollop of misery, be it a botched climate conference, or still-resilient investment in oil and gas.

And yet some of the most important climate developments in 2024 have barely made the headlines. We looked at three negative overlooked stories yesterday. Here are three positive trends you might have missed that may play out in more visible ways during 2025.

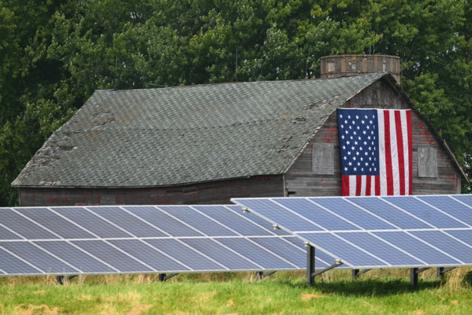

The sun also rises

The past year has been a brutal one for the Chinese companies that dominate the solar industry. A rush to build new production lines has sent capacity well ahead of current demand, forcing down prices and driving almost every player deep into the red. The six companies that dominate the sector will lose about 15 billion yuan ($2.1 billion) this year, based on the median of analyst estimates compiled by Bloomberg.

Things look a lot better in 2025, however: Bruised by the experience of 2024, big players are cutting capital spending while small- and medium-sized manufacturers are going out of business, tightening the market. A notoriously cyclical industry appears to be nearing another turning point: Bloomberg Intelligence reckons revenues will rise 25% in 2025, and analysts expect the big six’s net income to hit 11 billion yuan over the full year.

Europe shifts gears

Sales of electric cars in Europe have been dismal this year, with third-quarter volumes down 9% from 12 months earlier. That’s led to fears that the region could follow the U.S. in watching its transition to electric vehicles stall, leaving it far behind China, where half of new car sales now come with a plug. Don’t be so sure about that: From 2025, fleet sales in the European Union must be on average 15% more efficient than they were in 2021, a target that manufacturers are aiming to hit by whetting consumers’ appetites with a range of exciting new battery models.

Several new iconic designs are set to go on sale next year, from EV versions of the Range Rover, Porsche Boxster and Audi RS, to the Volkswagen AG ID2all — an electric Golf, in all but name — and the Ford Capri EV, which shares a name but not much else with the original gas-powered coupe. There’s also a dirt-cheap city car coming on the market from Renault SA’s Dacia marque, plus a host of Chinese imports that are likely to make their way past the EU’s new tariff barriers.

BloombergNEF expects 3.2 million plug-in cars to sell in Europe in 2024, up just 2% from last year. There’s a good chance that accelerates dramatically in 2025, and ends up north of 4 million vehicles.

Charging up the grid

You don’t need to buy any fuel to power a wind or solar farm, so it’s paradoxical that recent years have had some of the highest wholesale power prices in history. That’s because of a quirk of how electricity markets usually work: via minute-by-minute auctions where the price for everyone is set by the most costly generator that’s needed to meet grid demand. Historically, that’s always been a gas turbine, and spiraling prices for methane since the Russian invasion of Ukraine in February 2022 have meant daily peaks have often hit levels north of $10 a kilowatt-hour.

It’s an old adage of commodities that the cure for high prices is high prices, and that’s playing out right now. Lithium-ion batteries can increasingly provide peak power at costs that undercut gas, and there has been a rash of new installations as capitalists make efforts to arbitrage the price opportunity. The Texas and California grids each have about 11 gigawatts of batteries connected, sufficient to power Hungary for 12 months. That already seems to be keeping maximum costs lower than in previous years. As batteries get cheaper still, the grid volatility that has caused such angst in recent years may subside.

We made a similar list of overlooked stories last year. For the sake of honesty, let’s see how those predictions held up.

Coal consumption has peaked: When Russia invaded Ukraine and Beijing ordered its miners to dig up more solid fuel, there was a rash of headlines about a supposed “return to coal.” We argued that 2023 might instead prove the peak for global coal demand. That’s looking less likely now. The International Energy Agency reckons consumption rose again in 2024 and will plateau from 2023 out to 2027. November’s trade, output and inventory data in China, the biggest consumer, suggests consumption this year was only about 6.5 million metric tons, or 0.1%, higher than in 2023. But there’s little prospect of the precipitous drop that’s needed.

The wind rises: A spate of bad news for wind power toward the end of 2023 led to feverish claims that something was wrong with the entire business model. That doesn’t look to be the case, although developing markets such as China, Latin America and central Asia seem to be performing better than Europe and the U.S.

In global terms, installations will hit a record 124 gigawatts this year, according to BloombergNEF. They’ve upgraded their forecast for new 2024-2030 capacity by a cumulative 151 GW, 16% higher than 12 months earlier.

EVs are hitting price parity: It’s hard to credit it these days, but the big fear for EVs in 2023 was that soaring raw materials prices would prevent them competing on price with gasoline for years to come, if ever. In fact, the big story of 2024 was that falling lithium-ion prices had made Chinese electric cars so cheap that the U.S. and E.U. raised eye-watering tariff barriers to protect themselves. Parity is well and truly here: Average battery EV prices are now below $100 per kilowatt-hour, an oft-cited tipping point for that measure.

What to expect?

Averting catastrophic climate change was always going to involve plenty of steps forward as well as steps back. Still, there are plenty of positive trends out there, once you peer past the more alarmist headlines. However gloomy things may look right now, the transition to a cleaner global economy isn’t flagging yet.

_____

This column does not necessarily reflect the opinion of the editorial board or Bloomberg LP and its owners.

David Fickling is a Bloomberg Opinion columnist covering climate change and energy. Previously, he worked for Bloomberg News, the Wall Street Journal and the Financial Times.

_____

©2024 Bloomberg L.P. Visit bloomberg.com/opinion. Distributed by Tribune Content Agency, LLC.

Comments