Mark Gongloff: America's flood insurance system requires urgent fixes

Published in Op Eds

There’s an old saying that a recession is when you lose your job and a depression is when I lose mine. A similar logic applies to floods. Hurricane Helene brought a flooding disaster to southern Appalachia unlike anything seen since Katrina. But getting just an inch of water in your house could be life-changing in its own way.

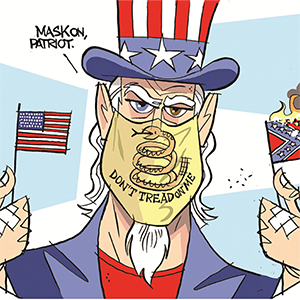

It shouldn’t have to be. A heating planet has made torrential downfalls more common and destructive, meaning Americans everywhere must be better prepared for the possibilities of catastrophic flooding — and not just from storms like Helene or the huge Hurricane Milton bearing down on Florida’s Gulf Coast. Fixing the country’s busted flood insurance system is a good place to start. The Federal Emergency Management Agency, which administers the National Flood Insurance Program, is running out of money after multiple disasters and a quadrupling of properties receiving repeated disaster payouts in the past 20 years.

Helene’s destruction puts the insurance problem into stark relief. The storm may do up to $250 billion in damage and economic loss, according to the latest estimate from the commercial forecaster AccuWeather. That would make it the second-most destructive storm in history after Katrina. It’s also the deadliest storm since Katrina, taking at least 230 lives so far.

But Standard & Poor’s estimates the insured losses from the storm will be just $5 billion to $15 billion. That’s a drop in the bucket compared with the $97 billion in profit the insurance industry netted in the first half of the year. What a relief for the insurance industry!

How did insurers get so lucky and homeowners so unlucky? It mostly comes down to flood insurance — or the lack thereof. Less than 2.5% of homes in Helene’s path were insured against rising waters, Bloomberg News reported. In Buncombe County, North Carolina, where hard-hit Asheville is situated, just 0.7% of homes had flood insurance, according to an NBC News estimate.

In fact, only about 4% of all U.S. homeowners have flood insurance, according to FEMA, mainly through its insurance program. Even in areas at high risk of flooding, less than a third of homes are insured against rising waters, according to a 2018 estimate by the Wharton School.

Homeowners are taking a lot of risk by passing up on flood insurance. According to FEMA, 99% of U.S. counties have flooded at one point or another since 1996, and 40% of its flood claims come from outside of high-risk zones. And all it takes is 1 inch of water in your house to do $25,000 worth of damage, the agency suggests.

But forget that number salad. All you need to know is that a heating climate means ordinary rainstorms now dump more water because hotter air holds more moisture, because physics. If you live in a place where it rains, then you probably need flood insurance. And it even rains and floods in Death Valley.

Many homeowners probably aren’t aware of this yet, partly because FEMA’s own flood maps are out of date and don’t reflect a changing climate. And many others may feel the risk is too low to justify the expense of flood insurance. The median annual cost is less than $800, which feels like a bargain compared with, say, $25,000. Too many people apparently don’t see it that way.

“Floods are low-probability but high-consequence events,” Wharton professor Robert Meyer, an expert on both insurance and consumer behavior, told me. “Our brains not well wired to make sensible decisions on that.”

Probably to cope with the bleak harshness of reality, humans have evolved to be both optimistic and amnesic, Meyer suggested. We think bad things only happen to other people and forget the pain when bad things do happen. People also tend to follow the crowd; if their neighbors aren’t getting flood insurance, then they think it’s fine for them to skip it, too.

Meanwhile, there are few structural incentives for people to buy flood insurance. It’s mandatory for homeowners with federally backed mortgages in FEMA’s high-risk zones, but those are few. And nobody else has to buy it. Some private carriers are starting to offer it, but consumers still have to seek it out. And that $800 you might spend on a premium buys a lot of gasoline and eggs.

Making flood insurance cheaper would make it more appealing. And the magic of insurance is that, when more people buy into it, costs fall. Publicly funded national or regional risk pools could be one way to accomplish this. Rep. Jared Moskowitz, a Florida Democrat, has proposed a “national catastrophic insurance fund” that would cover the gap between storm damage and what insurers can pay. As structured, it feels a little too much like a public bailout of insurance companies and might not fly politically.

But the goal of sharing risk is not a bad one. A recent working paper from the Climate & Community Institute think tank and several universities proposed creating Housing Resilience Agencies on national or regional levels to both pool and reduce risk.

Overhauling insurance regulation could be another approach. Kenneth Klein, a professor at the California Western School of Law, has suggested that insurers should be forced to include all perils in homeowners’ policies. This would lower the costs of insuring against often-excluded risks — not just floods, but earthquakes, mold and more — while also keeping all insurers on a level playing field. Insurers could also be made to cover all homeowners in a given state or lose the right to cover any of them.

FEMA’s flood program needs other long-term fixes, which my Bloomberg Opinion colleague Jonathan Levin has listed, including curbing subsidies for wealthy people rebuilding in risky areas. None of these will be easy. But as with so much involving climate change, making some difficult but necessary choices now will prevent far more expensive and painful choices in the future.

____

This column does not necessarily reflect the opinion of the editorial board or Bloomberg LP and its owners.

Mark Gongloff is a Bloomberg Opinion editor and columnist covering climate change. He previously worked for Fortune.com, the Huffington Post and the Wall Street Journal.

©2024 Bloomberg L.P. Visit bloomberg.com/opinion. Distributed by Tribune Content Agency, LLC.

Comments