Weather

/Knowledge

Damaging, golf ball-size hail will fall more frequently because of climate change, researchers warn

During severe thunderstorms, rising air shoots icy pellets the size of Dippin’ Dots ice cream into the bitter cold of upper atmospheric layers. There, supercooled water freezes onto the small particles to form hail, which then falls when it gets too heavy for the storm’s upward draft.

As climate change warms average global temperatures, ...Read more

Storms cause flash floods in Metro Detroit, cut power to thousands

Storms with heavy rain caused flash flooding across Metro Detroit early Monday evening, delaying flights at Detroit Metro Airport and leaving thousands of electricity customers without power statewide.

The Wayne County Airport Authority reported flooding at "several locations across the Detroit Metro Airport campus, including the Dingell Drive ...Read more

Searing heat threatens grids and health over nearly half the US

Nearly half the U.S. will wilt under hot, sticky conditions through the bulk of the week as temperatures and humidity soar from Chicago to New York City and New Orleans, boosting power demand and raising health risks.

Heat advisories and extreme heat warnings stretch from Nebraska to Long Island and from New Hampshire to northeast Texas.

...Read more

Tampa hits 100 degrees for 1st time in recorded weather history

TAMPA, Fla. -- Tampa temperatures climbed into triple digits for the first time in recorded weather history on Sunday.

Air temperatures read 100 degrees at Tampa International Airport, the National Weather Service’s Tampa Bay office wrote in a post Sunday about 3:30 p.m. on X.

Sunday’s heat broke the previous record of 99 degrees set on ...Read more

City by the Bay? More like City by the Brrr! San Francisco is having its coldest summer in decades

Time to cue that famed quote, often falsely attributed to Mark Twain: "The coldest winter I ever spent was a summer in San Francisco."

It's a cliche, sure. But this year it rings true. It really has been quite chilly in the City by the Bay, which is experiencing its coldest summer in decades, with no significant warm-up in sight and daytime ...Read more

Saharan dust plume to linger over South Florida this weekend, forecasters say

MIAMI — A plume of Saharan dust is blanketing South Florida this weekend, resulting in hazy skies, diminished air quality and lower-than-normal chances for rain, according to the National Weather Service in Miami.

The dusty air, originating from the Saharan Desert in Africa, is a regular seasonal occurrence that travels thousands of miles ...Read more

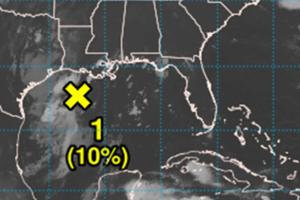

Hurricane center says Gulf system near Louisiana has small chance to develop

ORLANDO, Fla. — The National Hurricane Center continued Friday to track a low pressure system in the Gulf that could develop into the season’s next tropical depression or storm.

As of the NHC’s 8 a.m. tropical advisory, the broad area of low pressure was about 100 miles south of the coast of southwestern Louisiana disorganized showers and...Read more

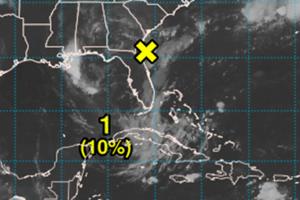

Hurricane center says Gulf system has small chance to develop

The National Hurricane Center continued Thursday to track a low pressure system that had moved into the Gulf after passing over Florida that could develop into the season’s next tropical depression or storm.

As of the NHC’s 2 p.m. Eastern time tropical advisory, the trough of low pressure had made it into the north-central Gulf with a broad...Read more

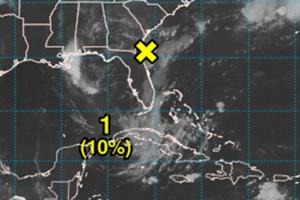

Hurricane center says Gulf system has small chance to develop

ORLANDO, Fla. — The National Hurricane Center continued Thursday to track a low pressure system that had moved into the Gulf after passing over Florida that could develop into the season’s next tropical depression or storm.

As of the NHC’s 8 a.m. tropical advisory, the trough of low pressure had made it into the north-central Gulf with a ...Read more

Trump OKs disaster declaration after northern Michigan ice storm

LANSING, Mich. — President Donald Trump has approved Michigan's request for a disaster declaration to help with the cost of cleanup efforts after a historic ice storm wiped out power for thousands in Northern Michigan.

Neither Trump, in a Federal Emergency Management Agency release, nor Gov. Gretchen Whitmer gave a dollar amount regarding ...Read more

Hurricane center says system moving across Florida could develop in Gulf

The National Hurricane Center continued Wednesday to track a low pressure system near Florida that could move west into the Gulf and develop into the season’s next tropical depression or storm.

As of the NHC’s 8 p.m. Eastern time tropical advisory, the trough of low pressure stretched into northern Florida and continues to produce scattered...Read more

Fort Worth man shares survival story after escaping Hill Country floods

FORT WORTH, Texas — The sounds of thunder and rushing water woke up campers and residents as the swollen Guadalupe River ripped cabins, homes and office buildings out of the ground, catching hundreds people off guard.

One of them was Christian Fell of Fort Worth. Water had rushed in his family’s vacation home, and now he was trying to reach...Read more

Trump denies FEMA funding for Western Maryland floods

President Donald Trump denied disaster assistance for Western Maryland on Wednesday that Gov. Wes Moore requested following massive floods that hit the region in May.

In a statement Wednesday, Moore, a Democrat, said that the flooding, which caused evacuations in Garret and Allegany counties after Georges Creek overflowed following three days ...Read more

Dangerous heat in Chicago to last through Thursday night, weather officials say

CHICAGO — Stifling heat and humidity will cover the Chicago area from Wednesday morning through Thursday evening, according to forecasters.

On both days, temperatures are expected to reach the mid to high 90s, with afternoon heat indexes between 100 and 110 degrees. The National Weather Service has placed a heat advisory in effect from 10 a.m...Read more

Hurricane center says system could move across Florida and develop in Gulf

ORLANDO, Fla. — The National Hurricane Center continued Wednesday to track a low pressure system near Florida that could move west into the Gulf and develop into the season’s next tropical depression or storm.

As of the NHC’s 8 a.m. tropical advisory the trough of low pressure stretched across Georgia into the Atlantic waters off Florida�...Read more

How a California cloud-seeding company became the center of a Texas flood conspiracy

Two days before the waters of the Guadalupe River swelled into a deadly and devastating Fourth of July flood in Kerr County, Texas, engineers with a California-based company called Rainmaker took off in an airplane about 100 miles away and dispersed 70 grams of silver iodide into a cloud.

Their goal? To make it rain over Texas — part of a ...Read more

New tropical system could emerge from area of low pressure near Florida, forecasters say

An area of low pressure near the southeastern coast of the United States could become the next named storm of the 2025 hurricane season, the National Hurricane Center said Tuesday night.

The system is forecast to move west-southwest over part of Florida and into the north-central part of the Gulf.

If it remains far enough offshore, conditions ...Read more

Peak hurricane season approaches. How warm is the Gulf of Mexico?

Recent hurricane seasons have been defined by storms supercharging over the Gulf of Mexico’s warmer-than-normal waters as they barrel toward Florida’s west coast.

Experts are hopeful that trend could wane this summer, though they still expect the season to be more active than typical.

Researchers at Colorado State University have ...Read more

As weather gets more extreme, so do conspiracy theories. Can cloud-seeding cause floods?

RALEIGH, N.C. — Even with his years of experience and the technology at his disposal, meteorologist Don “Big Weather” Schwenneker says it can be challenging to accurately forecast severe weather. But when a storm or hurricane hits North Carolina, bringing major flooding or damaging winds, a certain number of his ABC11 viewers will react in...Read more

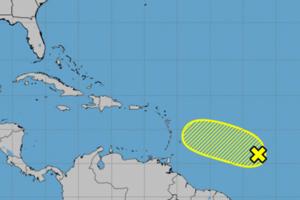

Hurricane center tracks Atlantic tropical wave with chance to develop

The National Hurricane Center continued Monday to assess a tropical wave moving across the Atlantic with a chance to develop into the season’s next tropical depression or storm.

In its 2 p.m. Eastern time tropical outlook, the NHC said the wave was located about several hundred miles east-southeast of the Caribbean’s Lesser Antilles in the ...Read more

Popular Stories

- Storms cause flash floods in Metro Detroit, cut power to thousands

- Searing heat threatens grids and health over nearly half the US

- Tampa hits 100 degrees for 1st time in recorded weather history

- Damaging, golf ball-size hail will fall more frequently because of climate change, researchers warn

- Hurricane center says Gulf system has small chance to develop