Science & Technology

/Knowledge

Rare purple sea creature found on SoCal beach. Could warming waters be why?

LOS ANGELES -- Oceanographer Anya Stajner was recently enjoying a sunset walk along the La Jolla Shores beach when a vibrant violet pop of color caught her eye in the sand.

She got down on her hands and knees and was astonished to realize she had stumbled upon a rare species of sea snail, Janthina janthina.

These creatures, more commonly ...Read more

EPA commits to '100% cleanup' of chronically polluted Tijuana River in memo of understanding with Mexico

Environmental Protection Agency Administrator Lee Zeldin committed the Trump administration to “a permanent, 100% solution to the decades-old Tijuana River sewage crisis” in a new agreement signed with Mexico on Thursday.

“I smelled for myself that foul smell that so many residents of Southern California have been complaining about for so...Read more

State board backs California Gov. Gavin Newsom's plan to give water agencies more leeway in meeting rules

California regulators are supporting a controversial plan backed by Gov. Gavin Newsom — and opposed by environmental groups — that would give water agencies more leeway in how they comply with water quality rules.

The Newsom-backed approach is included as part of a proposed water plan for the Sacramento-San Joaquin River Delta, released by ...Read more

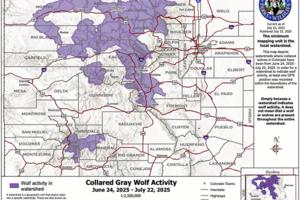

Colorado's wolves roam farther into northwest corner of state, new map shows

DENVER — At least one of Colorado’s collared wolves moved deeper into the northwest corner of the state in July, a new map released by state wildlife officials shows.

The wolf or wolves traveled broadly in Moffat County, from watersheds near the Wyoming border to the dry, rolling hills northwest of Craig along U.S. 40, according to the ...Read more

Groups escalate fight against Trump administration's order for west Michigan coal plant

Environmental groups have escalated their fight against the U.S. Department of Energy's order requiring Consumers Energy to extend the life of the coal-fired J.H. Campbell power plant in west Michigan.

Nine environmental groups led by Sierra Club and the nonprofit law firm Earthjustice filed a petition for review Thursday at the U.S. Court of ...Read more

With delay until 2026, Boeing Starliner next flight may not carry humans, NASA says

As SpaceX prepares to send up its 19th Dragon spacecraft with humans on board, the Boeing Starliner — which has only completed half of a crewed mission to date — remains in fix-it mode.

Its next launch is scheduled for no earlier than 2026, and then maybe not even one with crew, according to NASA.

In a press conference for the SpaceX Crew-...Read more

Georgia Tech is building a $20 million AI supercomputer

Georgia Tech has received a $20 million federal grant to build a powerful new supercomputer in Midtown that will harness artificial intelligence to boost the work of scientists across the nation.

Researchers hope the supercomputer, which Georgia Tech is calling Nexus, can lead to scientific breakthroughs like designing quantum materials and ...Read more

Tech companies want to move fast. Trump's 'AI Action Plan' aims to remove 'red tape'

The Trump administration on Wednesday laid out a plan that aims to make it easier for companies to quickly develop and deploy artificial intelligence technology.

The initiative shows how Silicon Valley tech executives who backed Trump during the election are shaping federal policy that will impact their businesses as they compete globally to ...Read more

Tech review: Big sound, small package

My wife is a preschool music teacher, and a big part of her curriculum is playing music in class.

She used to carry a small boombox about the size of a cigar box to play music from CDs.

Today she carries all her music on her phone and plays it wirelessly through a speaker connected via Bluetooth.

As the wife of a tech reviewer, she is my main...Read more

Tally of Microsoft victims surges to 400 as hackers exploit SharePoint flaw

The number of companies and organizations compromised by a security vulnerability in Microsoft Corp.’s SharePoint servers is increasing rapidly, with the tally of victims soaring more than six-fold in a few days, according to one research firm.

Hackers have breached about 400 government agencies, corporations and other groups, according to ...Read more

Trump urges looser rules, wider energy access in AI policy plan

The Trump administration called for boosting artificial intelligence development in the U.S. by loosening regulations and expanding energy supply for data centers under new guidelines that also urged withholding funds from states that put burdensome rules on the emerging technology.

The so-called AI Action Plan, released by the White House on ...Read more

White House unveils AI policy vision to spur US development

The Trump administration called for boosting artificial intelligence development in the U.S. by loosening regulations and expanding energy supply for data centers under new guidelines that also urged withholding funds from states that put burdensome rules on the emerging technology.

The so-called AI Action Plan, released by the White House on ...Read more

Tally of Microsoft victims surges to 400 as hackers exploit SharePoint flaw

The number of companies and organizations compromised by a security vulnerability in Microsoft Corp.’s SharePoint servers is increasing rapidly, with the tally of victims soaring more than six-fold in a few days, according to one research firm.

Hackers have breached about 400 government agencies, corporations and other groups, according to ...Read more

Tesla's darkening outlook to test robotaxi vision pushed by Musk

Tesla Inc.’s core car-making business is facing a deteriorating outlook, providing a major test of Chief Executive Officer Elon Musk’s ability to lift the stock price with his vision of a self-driving future.

The electric-vehicle maker is expected to post the sharpest drop in revenues in more than a decade when it reports earnings on ...Read more

Apple launches $20-a-month AppleCare One plan covering up to three devices

Apple Inc. is launching a new product-insurance plan that bundles coverage for as many as three devices, part of a broader effort to drum up subscription revenue.

The new offering is called AppleCare One and costs $20 a month, the company said Wednesday. The service also includes battery replacements, all-hours customer support and coverage for...Read more

Jim Rossman: Yes, you can trust Geek Squad

This week, a reader writes, “I have a Best Buy/Geek Squad account and in the years past I have allowed their techs to take over my PC remotely to clean it up so that it runs faster. Do you think I am taking any kind of risk, e.g., stolen account data, when I do this?”

This is a good question, and any time someone outside your home or ...Read more

Gadgets: Wi-Fi wherever you go

With the TravlFi JourneyGo 4G LTE Hotspot, you'll have Wi-Fi wherever you go.

The dark gray, pocket-sized (3.46 inches by 0.93 inches deep) travel-ready JourneyGo 4G LTE Hotspot ensures you have a secure internet connection at vacation destinations. It is designed to work virtually anywhere in the U.S., including on the road in an RV, in ...Read more

Review: In ‘Death Stranding 2,’ famed designer Hideo Kojima realizes game’s potential

The first time stepping into “Death Stranding” is bewildering. It’s a post-apocalyptic game without aliens, zombies or thermonuclear war. Rather than dealing with those familiar cataclysmic problems, it takes place in a world where the line between the living and dead have blurred with deadly consequences.

The human race is on the brink...Read more

Can artificial reefs in Lake Michigan slow erosion and boost fish population? Researchers aim to find out

Floating about 500 feet offshore of Illinois Beach State Park, Hillary Glandon tightened her scuba goggles, grabbed a small masonite plate from a nearby kayak and dove beneath the Lake Michigan surface.

The masonite plate, called a Hester-Dendy sampler, helps biologists like Glandon scrape algae off underwater rocks. Just a few feet below the ...Read more

These insects are endangering Sacramento's beloved oaks. Here's what you can do

SACRAMENTO, Calif. — Invasive beetles might be boring through the valley oaks in your neighborhood.

Mediterranean oak borers were first identified in the city of Sacramento last July. They target oaks native to Sacramento, those trees with arching canopies that line the American and Sacramento rivers, and can kill an 80-foot giant in five ...Read more

Popular Stories

- EPA commits to '100% cleanup' of chronically polluted Tijuana River in memo of understanding with Mexico

- Rare purple sea creature found on SoCal beach. Could warming waters be why?

- Groups escalate fight against Trump administration's order for west Michigan coal plant

- Tally of Microsoft victims surges to 400 as hackers exploit SharePoint flaw

- State board backs California Gov. Gavin Newsom's plan to give water agencies more leeway in meeting rules