The NAR settlement has changed rules for buyers and sellers, but classic advice still rings true

Q: I am giving Ilyce’s “100 Questions Every First-Time Home Buyer Should Ask” book to each of my young adult kids — and even though we’ve bought three homes over the years, I’m getting a copy for us, too, because it is such a helpful resource! Thank you for writing it.

Is there a place I can direct everyone to read your updates about the industry or with your financial advice since 2018? I just looked briefly at your website and that didn’t seem (at least on my phone) to be the place. I was initially thinking of the new Realtor fee guidelines (So confusing!), but there are no doubt other things that you might advise differently six years later because the world has changed.

Or perhaps you are readying a new edition?

A: Thanks for reaching out — and for giving your adult kids Ilyce’s book. That’s music to an author’s ears.

You’re right. The world of real estate has shifted again. Now that inflation has fallen down to around 2%, the Federal Reserve Bank has begun lowering interest rates. That’s making homeownership more affordable, and the Federal Reserve has indicated more reductions may be coming.

That’s the good news. We believe this will increase competition and, unfortunately, prices, for homes in most areas. Sellers still control most markets, which makes it tough going for buyers.

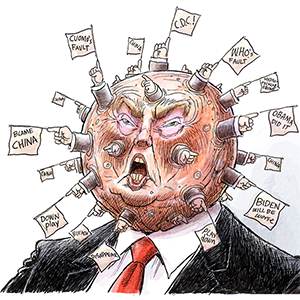

You’re correct that the National Association of Realtors (NAR) settlement has changed the rules for buyers and sellers. The goal of the settlement is to ultimately make it cheaper to buy and sell homes, but so far, all that seems to be happening is mass confusion. Buyers don’t like being on the hook for the commission and sellers aren’t necessarily passing along savings. Agents are in the middle. Again. It’s too soon to tell how this will all play out.

We recently sat with a real estate agent in California as he talked through a bunch of issues with a first-time buyer. There’s a lot for first-time buyers to unpack, especially as they’re getting used to jargon, sorting through neighborhood issues, and thinking about navigating the mortgage process.

We’ve written about the NAR settlement. You can find that information and more updates on ThinkGlink.com. The bottom line is we don’t think much will change, although buyers need to be prepared to work with a buyers broker, sign an agreement with their broker and pay a commission to their agent. We know it’s scary to be on the hook financially for a 2% to 3% commission on top of setting aside cash for the down payment, closing costs and moving. But, sellers will often agree to pay the commission.

There seem to be backdoor discussions happening between the agents and brokers about how the commission will be split. In most instances, the contract submitted by buyers will have an addendum to it whereby the seller will agree to pay the buyer’s agent a commission. This is why we don’t think much will change except the paperwork.

While the book predates the NAR settlement, Ilyce writes about how first-time buyers can work with buyers brokers. So, perhaps you can start there. The big difference is that signing the buyers’ agency agreement is now mandatory. This agreement documents that the buyer will pay their agent a fee for helping them find a home. This fee may be a percentage based on the purchase price of the home the buyer intends to buy or it may be a flat fee.

Remember, all commissions and terms in the buyer broker and listing agreements are negotiable. Some buyer’s agents may ask for a 3% fee, but you and the agent can agree on any amount or percentage. So, don’t be afraid to push back on the commission, particularly for expensive properties. Check out the National Association of Realtors’ FAQ page on the NAR settlement. Page four of the FAQ page has the highlights for buyers.

And, as Ilyce writes in the book, there are many types of arrangements buyers and their brokers can agree to. In the book, she discusses discount brokers, flat fee brokers, buyer’s brokers, among many terms used out there. Just remember you’re hiring a real estate agent to assist you in buying a home and the fee paid to that agent is something you need to feel comfortable with.

Ilyce isn’t currently revising the book, but you can sign up for her newsletter, called “Love, Money + Real Estate,” at https://glink.substack.com.

========

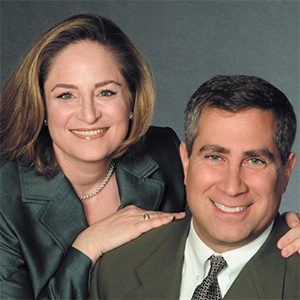

(Ilyce Glink is the author of “100 Questions Every First-Time Home Buyer Should Ask” (4th Edition). She is also the CEO of Best Money Moves, a financial wellness technology company. Samuel J. Tamkin is a Chicago-based real estate attorney. Contact Ilyce and Sam through her website, ThinkGlink.com.)

©2024 Ilyce R. Glink and Samuel J. Tamkin. Distributed by Tribune Content Agency, LLC.

Comments