Consumer

/Home & Leisure

'1000-Lb. Sisters' star Amy Slaton pleads guilty to drug charges after arrest at zoo

Amy Slaton Halterman of TLC's "1000-Lb. Sisters" has pleaded guilty to two counts of drug possession following her September arrest at a Tennessee zoo.

The reality TV star on Thursday submitted a plea deal at the Crockett County courthouse conceding guilt for "simple possession" of Schedule I and Schedule VI drugs, according to court records ...Read more

Private credit plots expansion in bid for $40 trillion prize

Private credit firms want more than corporate lending. The largest are laying the groundwork to finance everything from auto loans and residential mortgages to chip manufacturing and data centers in an effort to swell the size of the market by the trillions.

It’s part of a race to grab a bigger share of a universe of potential investments ...Read more

US existing-home sales rise as buyers accept high mortgage rates

Existing-home sales in the U.S. topped a rate of 4 million in November for the first time in six months as house hunters begrudgingly accept mortgage rates above 6%.

Contract closings increased 4.8% to an annualized rate of 4.15 million in November, the most since March, according to data released Thursday by the National Association of ...Read more

Real estate Q&A: Our neighbor flies drones near houses. What are our privacy rights?

Q: Our neighborhood has a few recreationalists who like to fly drones. One likes to fly near people’s houses at night — sometimes at altitude levels even with the home’s windows. We all know that drones are equipped with cameras. It can’t be right to allow such invasions of privacy. What are our rights, and what can be done? — Alan

A:...Read more

A stunning Brutalist concrete home in LA rivals its neighbor, the Hollywood sign

LOS ANGELES — Rising steeply above a ravine in the Hollywood Hills, Nina and Andreas Grueter’s concrete home conjures a villain’s lair in a James Bond thriller — John Lautner’s Brutalist Elrod House in “Diamonds Are Forever” comes to mind — with the nearby Hollywood sign adding to its cinematic allure.

For some, a narrow ...Read more

E*Trade plans zero-cost funds that only platform clients can buy

Morgan Stanley’s E*Trade is planning a suite of free funds, with a catch — only customers of the brokerage platform would be able to buy them.

The firm submitted plans on Monday for five mutual funds spanning stocks and bonds, according to a filing with the Securities and Exchange Commission. While all five funds would be zero-cost, buying ...Read more

One Colorado county's property values just plummeted. Here's why officials aren't panicking amid oil booms and busts.

The subject line of a press release this month from Weld County, Colorado, was stark and foreboding: “County’s assessed value sees 20% decrease.”

The cratering of taxable property value in the large county that hugs metro Denver’s northeast corner — from nearly $25 billion in 2023 to just under $20 billion this year — would probably...Read more

The average American household budget, at a glance

Many Americans spend a sizable amount of their income to keep a roof over their heads, food on the table and a means of transportation. Other items commonly found in household budgets include education, child care, health care, retirement savings and entertainment.

Inflation has cooled significantly from its 40-year-high in 2022, yet prices ...Read more

Warren Buffett's top 5 tips for surviving a bear market

Warren Buffett is among the greatest investors of all time. His company, Berkshire Hathaway, has returned around 20% annually since Buffett took over in the 1960s, trouncing the S&P 500’s annual return over that time period.

In 2024, Buffett has sold shares in some longtime holdings, such as Apple and Bank of America. The sales helped push ...Read more

After Los Angeles County bought a skyscraper, a fight over whether to tear down its historic headquarters

With the ink dry on the County of Los Angeles' $200-million purchase of the Gas Company Tower office building downtown, a fight is brewing over what to do with the 1960s-vintage headquarters it plans to leave behind.

Supervisor Janice Hahn and preservationists are pushing back against a plan to move workers into the newly purchased skyscraper ...Read more

Farmers Insurance expands home coverage in California, saying market has improved

Farmers Insurance plans to increase the number of homeowners insurance policies it will write and begin offering coverage again for new customers in other types of dwellings, citing improvements in California's home insurance market.

The Los Angeles-based company, the state's second-largest home insurer, said it will boost the number of ...Read more

Real estate Q&A: What can we do about neighbor's smelly and possibly dangerous pets?

Q: Our neighbor in the adjoining townhouse keeps multiple pets and does not take very good care of them. We can clearly smell the bad odor which ruins our backyard experience. Still, we kept quiet because she was otherwise a good neighbor, and we got along. Recently, she took in what we believe is a bobcat, and we are concerned it may be ...Read more

Investors have bought 131K homes in Las Vegas Valley since 2000

Investors have purchased approximately 131,710 homes in the Las Vegas Valley since the start of 2000, according to data obtained by the Las Vegas Review-Journal.

The valley posted the biggest increase of investor home purchases in the nation in the third quarter compared to the same quarter last year, at 27.6 percent, Redfin’s economic ...Read more

FDIC survey: Unbanked households hit record low

A record low number of households in the U.S. are unbanked, according to the 2023 Federal Deposit Insurance Corp. (FDIC) National Survey of Unbanked and Underbanked Households released Nov. 12, 2024. A household in which no members have a bank account, is how unbanked is defined by the FDIC.

This number has steadily decreased — from its ...Read more

5 ways to tell if you're on track for retirement -- and 5 things to do if you need to catch up, according to experts

Just because retirement planning involves some guesswork doesn’t mean it has to be a total mystery.

Whether you’ve been saving since your first job or you’re getting a late start, you can leverage expert-recommended strategies to gauge your progress on the road to retirement. And if you’re not quite on track, don’t sweat it — the ...Read more

10 Warren Buffett dividend stocks for passive income investors

Dividend stocks can be a great way to generate passive income as an investor, and what better way to find dividend stock ideas than by sifting through the holdings of arguably the world’s greatest investor, Warren Buffett?

Berkshire Hathaway’s portfolio is filled with dividend stocks, which should come as no surprise to Buffett followers. ...Read more

Rocket Mortgage sues feds over discrimination allegations

Rocket Mortgage is suing the federal government, seeking dismissal of a law suit that claims the Detroit lender discriminated against a Black homeowner who received an allegedly low appraisal when seeking to refinance her property loan.

Rocket Mortgage said Thursday that its federal lawsuit against the U.S. Department of Housing and Urban ...Read more

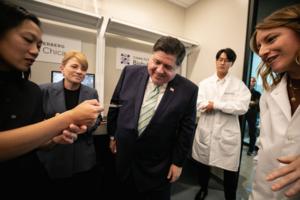

Chicago biohub backed by Mark Zuckerberg publishes its first research, discovering way to continuously monitor inflammation

A Chicago biomedical research hub backed by Facebook creator Mark Zuckerberg and his wife, Dr. Priscilla Chan, has produced its first published research — on discovering a way to monitor inflammation in real time using sensors implanted under the skin.

The study, co-led by Northwestern University researchers at the Chan Zuckerberg Biohub ...Read more

What's next for the 2025 real estate market? We may see better prices and more inventory

Whether you’re a renter, homeowner or potential buyer in South Florida, the new year may present you with some favorable changes in the housing market, according to real estate experts.

This could include better prices in 2025, as well as more options to choose from when deciding where to live, whether that’s renting an apartment or buying ...Read more

What the 2025 housing market might look like

The 2024 housing market was unpredictable.

Economists at the multiple listing service Bright MLS expected a busy market and for home prices to soften this year. But that hasn’t been the case across the Mid-Atlantic.

Sales have been slower than expected — nearly flat compared to last year. And home prices grew rapidly. In the Philadelphia ...Read more

Popular Stories

- '1000-Lb. Sisters' star Amy Slaton pleads guilty to drug charges after arrest at zoo

- Real estate Q&A: Our neighbor flies drones near houses. What are our privacy rights?

- The average American household budget, at a glance

- Private credit plots expansion in bid for $40 trillion prize

- US existing-home sales rise as buyers accept high mortgage rates