Zelle, bank scams cost customers millions each year. This senator wants reimbursements

Published in Home and Consumer News

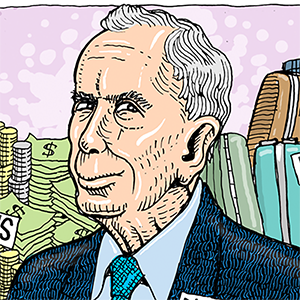

Consumers are losing millions of dollars every year due to financial scams in the fast-growing world of electronic money transfers, U.S. Sen. Richard Blumenthal, D-Connecticut, said Tuesday, calling for an end to loopholes allowing the problem.

The average loss to the consumer is in the range of $500, but that can be $3,000 to $5,000 for larger money transfers through Zelle, a financial payments network that is owned by major banks and is a competitor of the popular Venmo transaction service.

“Zelle purports to be an easy and fast way to send and receive money, but all too often it’s a fast and easy way to lose money,” Blumenthal told reporters. “Thousands of people use this platform that enables electronic transfers of money seemingly seamlessly, but often to fraudsters and con artists it is without the permission of the people who lose the money.”

Blumenthal is planning to craft legislation to ensure that consumers can be reimbursed for money that they have lost when mistakenly sending funds to scammers who they thought were legitimate. Out of $166 million in fraudulent claims during the past year, consumers were reimbursed for only $64 million, Blumenthal told reporters in Hartford.

After flying later Tuesday to Washington, D.C., Blumenthal, who is chairman of the Permanent Subcommittee on Investigations, was scheduled to hold a hearing that called for testimony from executives at three of the nation’s largest banks: J.P. Morgan Chase, Wells Fargo, and Bank of America. He is also seeking cooperation from the parent company of Zelle.

“Here is the fact that is most shocking to me: out of all the fraudulent losses of money that these banks and Zelle have an obligation to reimburse, only 38% put money back in people’s pockets,” he said. “They will say that often it is the fraudsters and the con artists who trick consumers into transferring money. No question that consumers should be on alert, but that is no excuse for the repeated, relentless failure of the banks and Zelle to reimburse when they should be doing better to protect the consumers.”

Blumenthal says the loopholes must be closed, even in a system that works well much of the time.

“The banks will say 99% of the transfers have no problem,” Blumenthal said. “The banks are saying (it’s) the cost of doing business. The banks are saying ‘not our problem.’ ”

A bank will contend “it’s not the one losing the money, so its insurance doesn’t apply to the consumer,” Blumenthal said. “It tells the consumer that it has no obligation to provide reimbursement. … It is a loophole in the FDIC legal regimen. Consumers have no idea about the loopholes and gaps that exist right now.”

He added, “Consumers who are called by someone purporting to be their bank or someone purporting to be an employer are not given some kind of warning.”

In response to the complaints, Zelle tells its customers on its website that they should report scams to the Federal Trade Commission and the Internet Crime Complaint Center.

“It is important that if you are enrolled in Zelle® through your bank or credit union to report the transaction directly to your bank or credit union,” Zelle says. “A scam is when you knowingly send money but do not receive what you expected in return. For example, someone pretended to be another person or a business and tricked or persuaded you into sending the money or promised that you would receive something in return that they did not provide. Certain impostor scams qualify for reimbursement.”

Zelle added that fraudulent transactions, in which someone hacks into a bank account and then makes Zelle payments, “typically qualify for reimbursement.”

In written testimony at hearing on May 21 in front of Blumenthal’s subcommittee, consumer rights attorney Stephanie R. Tatar said that the current law is inadequate in providing protections for customers.

“Because the consumer was involved in the transfer and authorized a payment, there is no remedy for the consumer under the Electronic Funds Transfer Act (“EFTA”), and no duty by the bank to credit the consumer’s account,” she said in written testimony.

The problem is so widespread, Tatar said, that she receives daily calls about scams from victims who are both young and old.

“Even the smartest, most technologically adept individuals are defrauded and lose money through fraudulent Zelle transactions,” Tatar said. “These victims come from all walks of life: students pursuing education, parents working to support their families, clergy serving their communities, doctors dedicated to healing, and farmers sustaining our nation’s agriculture. They represent the diverse fabric of our society, cutting across every vocation and background imaginable. These are honest, hardworking individuals who have fallen prey to sophisticated fraud schemes through no fault of their own.”

Blumenthal says he will continue working on the issue as long as consumers need assistance.

“All peer-to-peer payment apps are susceptible to fraud, no question about that fact,” Blumenthal said earlier. “And I want to be clear that fraud happens on all of them, but Zelle deserves particular attention because of its direct connection to trusted financial institutions. Zelle and the banks that own it offer to customers the appearance of the trust they feel they deserve. But the risks there are real and present, and they simply are failing to protect consumers in the way that they deserve.”

©2024 Hartford Courant. Visit at courant.com. Distributed by Tribune Content Agency, LLC.

Comments