A year later, where does the UAW's southern organizing campaign stand?

Published in Automotive News

The United Auto Workers' aggressive $40 million effort to organize nonunion car factories has cooled in recent months and is expected to face new challenges under a Trump administration that is less friendly with organized labor.

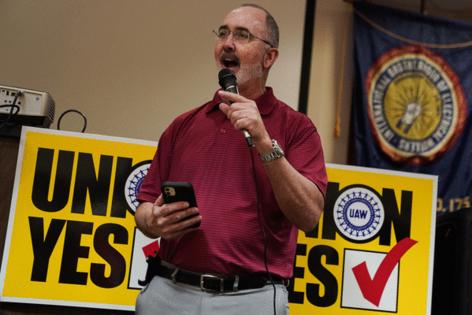

After winning big wage and benefit gains from Detroit's major automakers a year ago, the UAW announced plans to organize almost 150,000 additional autoworkers across more than a dozen companies, many of them in the South. The Big Three, President Shawn Fain said then, would in a few years be "a Big Five or Big Six."

But early momentum from a dominant election win at a Volkswagen AG plant in Chattanooga, Tennessee, in April has since tapered off amid a lost organizing election in Alabama, a Republican sweep of the 2024 election and likely change in the makeup of the National Labor Relations board.

To be sure, the union is making headway on a few fronts, such as bargaining a first contract for the approximately 4,300 hourly Volkswagen workers, and solidifying support at several new battery plants, including those that will supply Ford Motor Co. and General Motors Co. electric vehicles.

But after losing a unionization vote at a Mercedes-Benz complex in Alabama in May, there have been few public signs of progress organizing new foreign automaker plants the UAW had targeted. Those include a Hyundai Motor Co. assembly plant in Alabama, and a Toyota Motor Corp. cylinder head facility in Missouri, both of which had announced growing UAW support among employees in the spring. Several workers involved in the union campaign at both plants didn't respond to requests from The Detroit News for a progress report.

"For I don't know how long, we've been told we can't win, we can't win in the South, and we win, and now we're told we're not winning fast enough," Fain told The Detroit News in an interview last month. "Things are going great, and we're going to continue to do what we're doing."

He acknowledged in a recent article in the Wall Street Journal that the union's organizing push is "in a different phase now," though he added the effort will take time, and underlying worker enthusiasm for unionization remains. The union's International Executive Board said in February that the $40 million it planned to spend on organizing would extend through 2026.

"They're trying to do a couple of things to build new momentum," said Stephen Silvia, an American University professor who wrote "The UAW's Southern Gamble" and has closely tracked the union's recent organizing push. "One of them is the negotiation of the Volkswagen contract, and getting a contract that they can then use to go to other places and say, 'This is what we can get.' "

In addition, Silvia said, UAW officials are recently focused on growing support at BlueOval SK battery facilities in Kentucky and Tennessee that are joint ventures between Ford Motor Co. and South Korean firm SK On.

To that end, the union announced last month that a supermajority of workers at the BlueOval plant in Kentucky — slated to start production next year — had signed union authorization cards and were starting their campaign to join the union.

In Tennessee, meanwhile, a majority of roughly 1,000 workers at the GM and LG Energy Solution joint-venture Ultium Cells LLC battery plant in Spring Hill also opted to join the union in September via a card-check system.

There is also interest in trying again at the Alabama Mercedes plant, where the union lost its election with 56% opposed last May, said Silvia, who added he had not heard of organizing progress at either the Hyundai or Toyota facilities the union initially targeted.

“We can still do some things behind the scenes and try to gain some more support,” said Kirk Garner, a 26-year Alabama Mercedes employee who has worked on unionizing the plant since 2000, adding the workers in favor of the union probably won’t start campaigning until the spring. Workers have to wait until next May to seek the signatures needed to have another vote.

A National Labor Relations Board ruling in November labeling captive-audience meetings by employers as unlawful under the National Labor Relations Act could benefit the effort, Garner noted. In a decision against Amazon.com Services LLC, the board found it unlawful for an employer to require “employees under threat of discipline or discharge to attend meetings in which the employer expresses its views on unionization.”

“Whether they try to fight us again, like they did last time, you know, they might,” Garner said. “I just don't think the company can do anything to change people's mind. We had several thousand people voted for us, and those people are probably still going to be with us.”

Susan Schurman, distinguished professor of labor studies and employment relations at Rutgers University, said the union doesn't have a choice other than continuing to try to organize more plants in the South.

That's where many auto manufacturers, both foreign and domestic, are locating their plants in recent years, and that trend will continue if it means automakers can pay less for labor. In 2023, the UAW's membership shrunk to about 370,000 members, the lowest number since the Great Recession.

"The rule in labor organizing is, you have to organize the critical labor market," Schurman said. But the UAW also must prepare to play the long game, even if it means losing elections on the initial try.

She added the good news for the union's prospects is that it is building out a more durable organizing framework this time around that is less reliant on a "blitz" of outsiders coming in to run a campaign. Instead, it is more focused on workers creating their own internal structure.

Experts said the impact of Donald Trump's election on the UAW's plant organizing push is tough to predict. On one hand, they said, Trump's first administration was notably anti-union and pro-company, including his National Labor Relations Board appointments and the board's decisions and rulemaking.

But this time they noted he's sending a different message, opting for a pro-union Republican to lead the Department of Labor, U.S. Rep. Lori Chavez-DeRemer of Oregon. She was among only a handful of GOP lawmakers who co-sponsored the PRO Act, sweeping legislation aimed at expanding labor rights and banning union-busting tactics.

"It's possible, or conceivable, that Trump will give an olive branch by not being quite as directly anti-union, because I think there was a significant number of union folks that voted for him," said Art Wheaton, director of labor studies at Cornell University's School of Industrial and Labor Relations.

Schurman, though, said she expects it will be more difficult for the UAW under a Trump presidency, despite some early mixed signals. Yet if the union can get high enough worker support in a plant, she noted, it won't matter, and the employer may opt to voluntarily recognize the union.

"An NLRB election is going to get even more difficult under Trump, and it's been difficult during Biden because of vacancies on the board," she said. "The Republican Party, and conservatives in general, and corporations in general, have made an all-out assault on the National Labor Relations Board, and that will continue, I have no doubt."

©2024 www.detroitnews.com. Visit at detroitnews.com. Distributed by Tribune Content Agency, LLC.

Comments