'More change than usual:' Big revisions in drug plans and healthcare benefits ahead for Florida Medicare recipients

Published in Health & Fitness

FORT LAUDERDALE, Fla. — Big Medicare changes will go into effect in 2025, giving Floridians more reason to sift through plans and make smart choices.

The 5.1 million Floridians who qualify for Medicare will have from Oct. 15 through Dec. 7 to choose original Medicare or one of the Medicare Advantage plans offered in their county.

Changes to Medicare in 2025 will include a $2,000 limit on out-of-pocket Part D drug costs, an opt-in payment plan for expensive medications, and some potential broad changes in Medicare Advantage plans that could eliminate your current plan or slim your benefits.

Some insurers, such as Aetna and Humana, will offer fewer Medicare Advantage plans in 2025, but the Centers for Medicare and Medicaid Services says there will be plenty of choices overall. In Florida, 21 more Medicare Advantage plans will be offered in 2025 than in 2024. However, Cigna Healthcare for example, did not renew its Medicare Advantage PPO plan in Florida in 2025, offering only its HMO plan and a plan for military veterans.

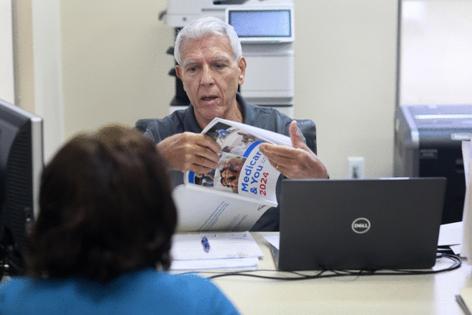

John Raite, a counselor with Broward County SHINE (Serving Health Insurance Needs of Elders), said he has been assisting seniors with Medicare choices whose 2024 plans are discontinued.

“Some companies are doing away with some plans, but they have other plans to choose from,” Raite said. “It’s a matter this year of shopping the plans available to see which is the best substitute for a plan that is being dropped.”

The Centers for Medicare and Medicaid Services announced that benefit offerings, overall, in Medicare Advantage plans are similar to last year, and premiums are decreasing. The average premium for Medicare Advantage plans will drop 6.7% in 2025 to $17, including Special Needs Plans. However, trade groups and insurance brokers recommend seniors look carefully at benefit offerings because insurers have redesigned some plans and options overall will offer fewer supplemental benefits, higher prescription drug deductibles, and larger annual out-of-pocket cost caps. Nearly all Medicare Advantage plans, though, will continue to cover vision, dental and hearing, some more generously than others.

“This year, you definitely will want to check the plan before you join to find out what benefits it offers, how much they cost, and if there are any limitations,” said Beatrice Scafidi, SHINE Liaison at the Area Agency on Aging Palm Beach/Treasure Coast. “Don’t just go off what your plan offered last year.”

Scafidi advises the seniors to call their doctors and specialists before committing to a plan to ensure they remain covered. More hospital systems are leaving Medicare Advantage plan networks so you should look at the plan’s network directory and make sure your doctor and hospital are included. Scafidi also recommends considering the out-of-pocket costs for specialists. Some plans are raising that cost, she said.

“Make sure the out-of-pocket is an amount you can afford,” she said.

With traditional Medicare, you don’t need a referral to use a specialist in most cases or prior approval to use a covered benefit. It differs from Medicare Advantage plans, which typically require referrals but offer extra perks like fitness programs and some vision, hearing, and dental services (like routine checkups or tooth cleanings).

In 2025, Medicare Advantage beneficiaries may find fewer plans with the type of supplemental benefits that lured them in previous years.

“Plans are changing their benefits this year, so you don’t want to assume anything about your plan,” said Louise Norris, a health policy analyst for medicareresources.org. “Everyone should have received their annual notice of change from their carrier in September that outlines everything that will change in 2025. You need to open it and read it.”

Norris says more people than in prior years will need or want to enroll in a new plan.

She also expects to see Medicare Advantage plans to change their covered medications and recommends that plan-holders check coverages and prices before signing up.

“There is going to be a lot of variation from one plan to another on what they are changing,” she said.“You don’t want to find out too late your plan no longer covers that dental procedure you need or medication you take every month.”

According to healthcare firm ATI Advisory, fewer plans will offer benefits such as fitness memberships and non-emergency medical transportation in 2025. Also, expect to find less coverage for over-the-counter healthcare products and nurse hotlines, ATI Advisory cautions.

“If those benefits are important to you, then you want to make sure your plan still offers them,” said Allison Rizer, executive vice president of payer solutions at ATI Advisory.

“Start early looking at the benefit package for the different plans,” Rizer suggests. “There is going to be more change than usual, so you will want to look at premiums, cost sharing, provider network, and how benefits have changed.”

Tyler Cromer, director of ATI’s Complex Care Program, Policy, and Research Practice, said anyone in a dual-enrolled plan that encompasses Medicare and Medicaid will notice “extra offerings” in those plans. “All those extras are important, but does the plan pay for your medical care? Are your providers in the network?”

Some other big changes this year:

Mid-year notices

Everyone enrolled in a Medicare Advantage plan will receive a mid-year statement in July. “It will show available benefits that you haven’t used,” Cromer said. It also will show how to access those benefits.

“I can say confidently that we do not all read our plan documents cover-to-cover, so it is easy to miss benefits available,” she said. “It will be a positive for consumers to learn mid-year what those unused benefits are.”

Drug costs

Medicare changes include the elimination of the Medicare “donut hole” and a limit on how much you’ll have to pay out-of-pocket for covered prescription drugs. In 2025, Part D drug plans and Medicare Advantage plans must cap out-of-pocket spending on covered medications at $2,000 a year.

“It’s the first time in the history of the Medicare program that people have a cap on how much they could have to pay out-of-pocket,” Dr. Meena Seshamani, the director of the federal Center for Medicare, said in an interview with AARP.

Raite at SHINE in Broward said already he can see that the $2,000 cap will be a big cost savings for some seniors.

“A lot of drugs are very expensive, and that savings might have a big impact on their expenses in 2025,” he said.

Also, Medicare is offering a new payment plan you can opt into to spread out your medication costs. The payment plan would allow you to pick prescriptions up from the pharmacy and pay for them over a period of months.

“You can opt-in anytime throughout the year, but doing so at the beginning will allow you to spread your costs throughout the calendar year,” said SHINE’s Scalfidi. “It will allow people to afford their medications.”

Drug plans

Floridians will have fewer choices in stand-alone drug plans in 2025:16 in 2025 compared to 21 in 2024.

That follows a national trend: The number of stand-alone Part D plans is dropping by about a quarter, to the lowest number ever. Also, many of the remaining plans have higher deductibles or are as moving medications to coverage tiers that have higher copayments.

CMS estimates that about 72% of Florida seniors with a stand-alone Medicare prescription drug plan will have access to a plan with a lower premium in 2025. To make up for that, plan-holders may see bigger deductibles and changes in formulary drug tiers. Because of larger deductibles, more policyholders may want to use the payment plan being offered this year.

Medicare Advantage plans that include drug coverage also may change their prescription medication programs and introduce new premiums, formularies, and co-pays. By some estimates, the average pharmacy deductible will rise from $147 to $394, a 167.3% increase,

Cromer at ATI Advisor recommends comparison shopping using the Medicare Plan Finder tool.

“It’s important to make sure you are getting the best drug plan for you,” she said.

Star ratings

The CMS rates Medicare Advantage and Part D plans on a scale of 1 to 5 stars based on up to 40 criteria. These include factors like how many preventive screenings are covered, how long it takes to get an appointment, and how many complaints the company has received. Rating criteria change slightly each year, and each Medicare plan is reevaluated annually.

This year, CMS is significantly modifying its method for star ratings, and industry consultants expect to see fewer five-star plans than ever before.

“If a plan has a very low star rating, that’s something to pay attention to,” Cromer said.

Cromer cautions that star ratings are more national in scope and don’t necessarily reflect how the plan operates within a specific county.

“Know that a star rating is not a perfect measure of quality for you,” Cromer said. “If you see a plan has five stars, that’s a good signal, but benefits and physician networks may be more important to you and your healthcare experience.”

--------

©2024 South Florida Sun Sentinel. Visit at sun-sentinel.com. Distributed by Tribune Content Agency, LLC.

Comments