With student loan forgiveness programs in limbo, here's how some borrowers may find relief

Published in Slideshow World

Subscribe

With Biden's student loan forgiveness plan in limbo, here's how some borrowers may find relief

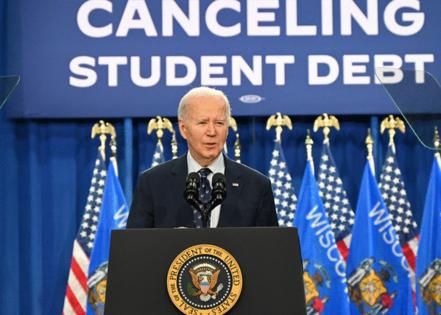

In late August 2024, the latest chapter in the ongoing student debt forgiveness debate came to a close—for now—when the Supreme Court announced it would uphold a block on the Biden-Harris administration's sweeping student loan repayment plan.

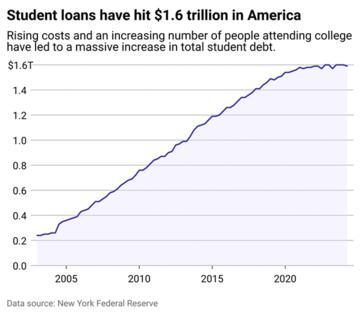

With an unprecedented $1.74 trillion in collective student debt, Americans are struggling with repayment. The 42.8 million borrowers with federal student loan debt carry an average balance of nearly $38,000, according to the Education Data Initiative. Nearly half have not restarted payments after a moratorium on monthly repayments was lifted in late 2023.

Although the Biden administration has so far relieved about $167 billion in debt for about 4.75 million people, the sweeping Saving on a Valuable Education plan, better known as SAVE, was intended to go further by lowering monthly payments for millions of Americans, providing relief at a historical moment when higher education has never been more expensive.

Students seeking a college education in the United States today will spend nearly double the global average on a degree, according to the Organization for Economic Cooperation and Development. On average, over the past 20 years, tuition and fees at a public four-year institution have increased by 140%, adjusted for inflation.

Meanwhile, the U.S. is falling behind its global counterparts in some aspects of education. The average ACT test composite score hit a 30-year-low in 2023, and college enrollment levels dropped 8% between 2019 and 2022.

While Americans largely agree that higher education is prohibitively expensive, young adults today nevertheless continue to face a difficult decision: earn a costly degree with the potential for higher earnings over time or decide against college and avoid taking on high-interest debt in the foundational years of their adulthood.

Learner analyzed news reports and economic research to see how the White House's student debt relief programs are affecting borrowers.

Visit thestacker.com for similar lists and stories.

Loan forgiveness stimulates economy while increasing long-term debt

Student loan forgiveness went on a trial run in March 2020, when the Trump administration issued a moratorium on student loan payments and interest accrual amid the economic uncertainty of the COVID-19 pandemic. The Higher Education Relief Opportunities for Students Act of 2003, which gives the executive branch the authority to change the terms of student loans amid national emergencies, made the temporary suspension possible.

The Biden administration subsequently extended the pause six times, capping off the relief effort with an executive order to forgive up to $10,000 to $20,000 per eligible borrower. However, the Supreme Court struck down this proposal in June 2023, with the conservative majority opining that only Congress had such authority.

Four years after the initial moratorium, the economic impact of loan forgiveness is becoming clear. A 2023 study by the National Bureau of Economic Research found that freezing student loan payments during the COVID era stimulated the economy; borrowers had more money to spend on other goods and services across the nation. However, simultaneously it increased long-term debt for those who did not qualify for paused loan accrual.

The Biden administration has continued pursuing student debt relief via alternative means, launching the SAVE Plan, an income-driven repayment plan, in August 2023. Though targeted at low- and middle-income earners, all borrowers can use the Department of Education's Federal Student Aidloan repayment simulator tool to see if the plan is applicable to them.

For eligible borrowers, the plan eliminates any accrued monthly interest as long as the borrower makes their monthly payment on time. The program caps payment amounts at 10% or 5% of the borrower's discretionary income—meaning as income increases, so too will monthly payments. Borrowers with balances under $12,000 who opt into this plan may also be eligible for forgiveness after 10 years; every additional $1,000 borrowed obliges an additional year of monthly payments up to 20 to 25 years.

This plan's implementation remains blocked following the Supreme Court's August decision to reject a request from the Biden administration to lift a federal appeals court order that mandated it be put on hold. Until these legal challenges are resolved, loans will not accrue interest, and the Department of Education is providing regular updates.

Despite the uncertainty and delays, some borrowers remain eligible for debt relief today. Those who attended schools that defrauded or misled them may be eligible for the borrower defense loan discharge. To date, this includes institutions such as Phoenix University, DeVry University, ITT Technical Institute, and the Art Institutes. Despite a recent injunction delaying the implementation of this plan, the Education Department is continuing to process applications and encourages eligible borrowers to apply for relief, providing regular updates via theprogram's webpage.

Additionally, under the Public Service Loan Forgiveness plan, employees of government or not-for-profit organizations are eligible for student loan relief if they have made consistent payments for at least 10 years. Created in 2007, the PSLF plan includes debt forgiveness for public school teachers, professors at public colleges and universities, and members of the U.S. military. Borrowers can use the Department of Education's search tool to see if they qualify.

Women, especially Black women, tend to shoulder a greater debt burden

Though student loans cut across all demographics, Black women carry a disproportionate amount of the trillion-dollar debt total. Advocates of student loan forgiveness point to it as a potential pathway for narrowing the racial and gender wealth gap. On average, Black adults and women take on greater amounts of student debt than their white and male counterparts. When they enter the workforce, they are paid less on average.

Detractors of student loan forgiveness, including some economists, have criticized the platform as regressive, noting that it benefits higher-income households with higher levels of debt. According to a 2023 Brookings Institution analysis, those with the highest levels of student debt tend to be high earners with graduate degrees. While this is true, plans like SAVE that are targeted toward lower- and middle-income borrowers are designed to bridge these gaps and create equity.

Though the SAVE Plan is on hold, borrowers still have payments paused amid expected legal challenges. And for those who do not qualify, did not benefit, or had relief rescinded under previous initiatives by other branches, new opportunities for student debt relief may soon emerge: The Biden administration is poised to announce another student debt relief initiative in the fall.

In August 2024, the Department of Education emailed borrowers about opting out of future debt relief programs. Though the rules of pending programs are still being finalized, they could expand student debt relief to over 30 million borrowers, including those who owe more than they did at the start of repayment, have been in repayment for decades, or enrolled in low-value programs.

Story editing by Alizah Salario. Additional editing by Kelly Glass. Copy editing by Tim Bruns.

This story originally appeared on Learner and was produced and distributed in partnership with Stacker Studio.

Comments