As other banks report decline in deposits, US Bancorp experiencing a surge

Published in Business News

As other banks report declines to their average deposits, Minneapolis-based U.S. Bancorp, the parent company of U.S. Bank National Association, has experienced a surge in that segment despite an uncertain rate environment.

For the bank's first quarter ended March 31, average total deposits increased $279 million, or 0.1%, from the fourth quarter of 2023. PNC, meanwhile, reported Tuesday its average deposits decreased $3.8 billion, or 1%. "reflecting seasonally lower commercial deposits."

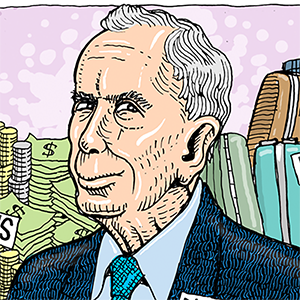

Chief Executive Andy Cecere told analysts on a conference call Wednesday the bank is seeing consumer deposit growth despite the impact of quantitative tightening on industry deposit levels, which essentially are policies that reduce the Federal Reserve's balance sheet.

After a series of interest rate increases to slow high inflation between 2022 and January of this year, Fed policymakers had indicated they planned to start lowering rates this year now that inflation has slowed back down. However, after two months of lower but stubborn inflation, Fed officials have also floated the idea of keeping those rates steady.

The rate hikes led to a rise on yields in bank deposits, which has been good for consumers.

"We're competitive there and we want to make sure that we're growing and we have been growing," said John Stern, chief financial officer for the Minneapolis-based bank, told analysts.

Average total savings deposits increased $3.7 billion at the bank in the quarter. Time deposits, accounts where deposits are locked up for a certain amount of time, grew 4.6% while money market savings grew 4.9% from the previous quarter. Year over year, average total savings deposits were up $18 billion, or 5.2%, while average time deposits were up $19.7 billion, or 55%, respectively, compared to the same quarter in 2023.

"We get a lot of inflow at the end of the quarter as people prepare for outflow payments and end of the month type payments," Stern told analysts. "Sometimes they just hold it all the way through the tax season. That's exactly what we've seen here. You get this kind of surge at the end of the quarter. It holds through tax day and then it starts to wind down and that's been very seasonal. It's just a bigger number than what we have typically seen."

Overall, U.S. Bancorp reported net revenue of $6.7 billion and net income of $1.3 billion, or 78 cents per share. The company's stock was down 4.2% in mid morning trading.

Net interest income for the quarter was $4 billion, down from $4.6 billion in the year-ago quarter, but was within the company's guidance, "albeit on the lower end of the range," Cecere said.

"Loan and deposit growth remains under pressure for the industry, and that dynamic impacted our net interest income," he said.

The bank recorded $155 million in merger costs related to the Union Bank acquisition, and a $110 million charge for the increase in the Federal Deposit Insurance Corp. special assessment to help replenish the government insurance fund used during the meltdown of Silicon Valley Bank and Signature Bank.

For its fourth quarter, U.S. Bancorp got hit with a $734 million bill to help replenish the government insurance fund.

©2024 StarTribune. Visit at startribune.com. Distributed by Tribune Content Agency, LLC.

Comments